Understanding of EA Form

EA Form is generally split into 6 parts. Part B and Part C are the total taxable income of the employees (include directors). Sum of both parts are suppose to fill into employees respective individual BE form, column “B1”.

EA表格从A至F,共分6个类别。要注意的是,填在B和C部分的收入都属于可征税收入,两者加起来的总额,就是员工得填入BE表格“B1”(法定就业收入)一栏的金额。

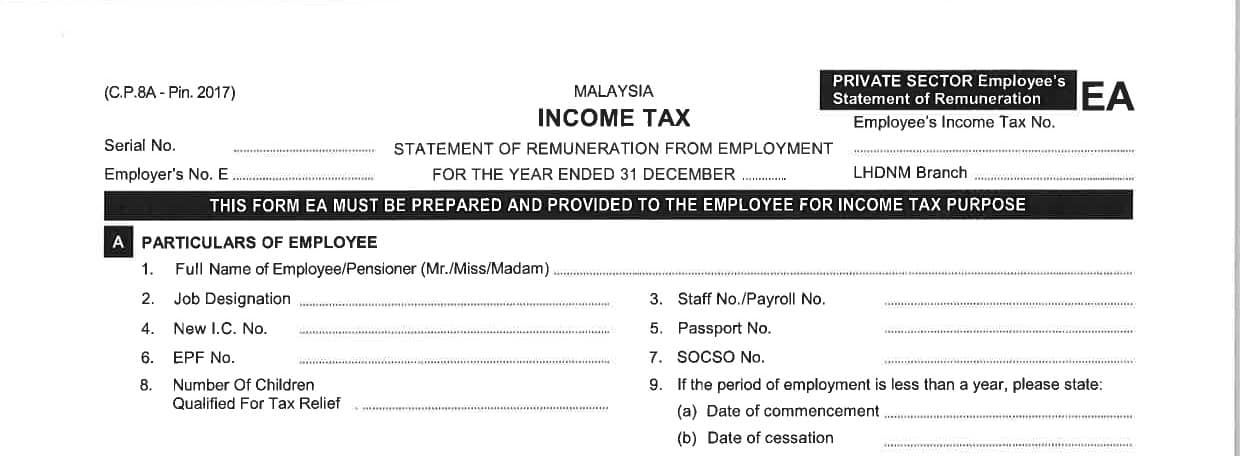

Part A: Employee detail (雇员资料)

Employer (Company) need to fill in the employees information such as names, employee number (internal), NRIC number, KWSP (EPF) number. If an employee on employment service less than 1 year such as recruited / commenced / resigned / terminated employment, please fill in the date of commencement or last date of ceased employment.

Employer (Company) need to fill in the employees information such as names, employee number (internal), NRIC number, KWSP (EPF) number. If an employee on employment service less than 1 year such as recruited / commenced / resigned / terminated employment, please fill in the date of commencement or last date of ceased employment.

雇主会在此部分填上员工资料,包括名字、职位、职员编号、身分证号码、雇员公积金号码等。如果有关员工任职不超过一年,例如去年中才加入或离职,就会显示任职和离职的日期。

Part B: Employment income, Benefit and Living Accommodation (exclude tax exempt allowance / Perquisites / gifts / benefit) (就业收入、福利与住宿 -不包括免税津贴/额外现金奖赏(Perquisites)/礼物/福利)

Employment incomes are divided in to 6 types. If an employee had a simple remuneration package (salary, bonus, allowance and director fee only) and the company didn’t provide benefit in kind / free accommodation, employer / company needed to fill in item 1(a), 1(b), 1(c) only. If the company provided Benefit in Kind and/or free living accommodation, employer / company need to determine the benefit give to employee using formula method or prescribe value method set by LHDN and require to fill in item 3 and item 4. You may refer public ruling PR 11/2019 at the following link:

Benefit in Kind (BIK) (员工福利计算法): http://lampiran1.hasil.gov.my/pdf/pdfam/PR_11_2019.pdf

Value of Living accommodation (VOLA) (员工住宿计算法): http://phl.hasil.gov.my/pdf/pdfam/PR3_2005.pdf

此收入部分共分6项,如果薪酬配套相对简单,雇主没有提供汽车或住宿等物质福利的话,通常只有在第1项注明过去一年的3种收入(item 1(a), Item 1(b) and item 1(c))。如果薪酬配套内包括物质福利,雇主必须根据税收局的方程式来计算其价值,然后填写在 item 3 和 item 4。想了解如何计算物质福利,请点击以上链接。

1(a) – 薪资、工资或有薪假(包括超时工作津贴)、1 (b) – 收费(包括董事费)、佣金或花红、1(c) – 小费总额、额外现金奖赏、奖金或酬金,或其他津贴、1(d) – 公司帮员工承担个人税得税 (如果员工合约列明公司为员工提供此福利)1(e) – ESOS / share option scheme, 1(f) Gratuity.

2.之前年份的延滞付款(payment in arrears)和其他付款细节

3.物质福利价值(Value of benefits-in kind)

4. 住宿福利价值(需注明地址)(value of living accommodation)

5. 未经批准的退休金、计划或社团退款 (refund fro unapproved fund)

6. 失业赔偿 (compensation for loss of employment)

Part C: Pension and other (退休金与其他)

Fill in the pension fund (note: this is no EPF/KWSP), annuities, other periodical payment. (this column seldom in use)

此栏须填上员工的退休金(注意:这不是EPF / KWSP),注明年金或其他定期付款。

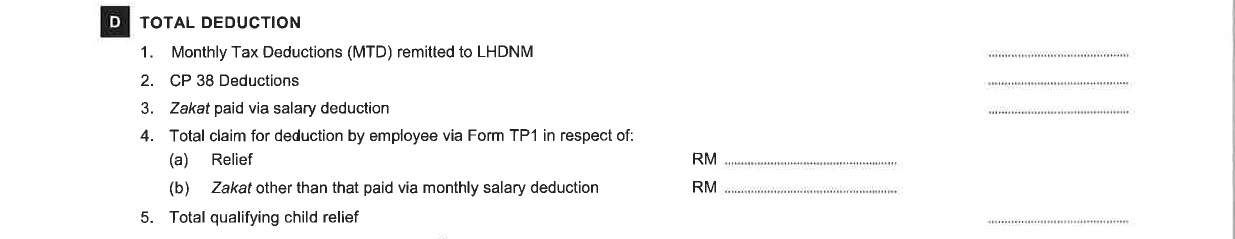

Part D: Total Deduction (扣除总额)

1. PCB (MTD) amount, company deduct from employee’s salary and paid on behalf to LHDN (今年已付税收局的每月预扣税金)

.

2. CP 38 is employer received instruction from LHDN to retain/deduct certain value of employee salary and pay to LHDN due to employee owed LHDN personal tax. (CP 38扣款(即税收局向积欠税款的纳税人雇主,发出“扣除工资令”,要求从有关雇员薪资直接扣除未付的所得税;已扣除总额会显示在此。)

3. Zakat (伊斯兰援助金 – 天课)

4. Relief . employee thru Form TP1 to inform their relief entitlement. (员工通过表格TP1扣除的回扣金额)

5. Total qualifying child relief (孩子回扣金额)

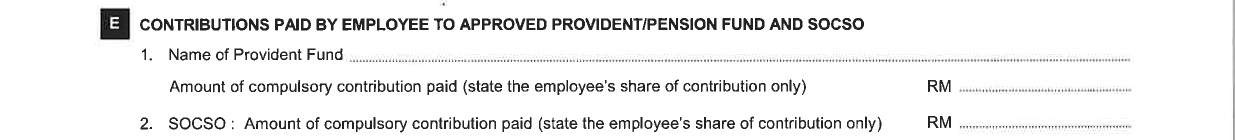

Part E:Contribution paid by employee to approved provident /pension fund and SOCSO (获批准退休金或公积金、基金或社团的缴纳总额)

In part E column 1, please fill in “KWSP” and amount contributed to KWSP (EPF) (Note: EPF employee’s portion only, employer’s portion not require to fill in here

In part E Column 2, please fill in amount contributed to PERKESO (Socso)

E部分:获批准退休金或公积金、基金或社团的缴纳总额

此栏会注明有关公积金名字,一般是雇员公积金;及雇员已缴纳的总额。雇主部分不必注明在此。

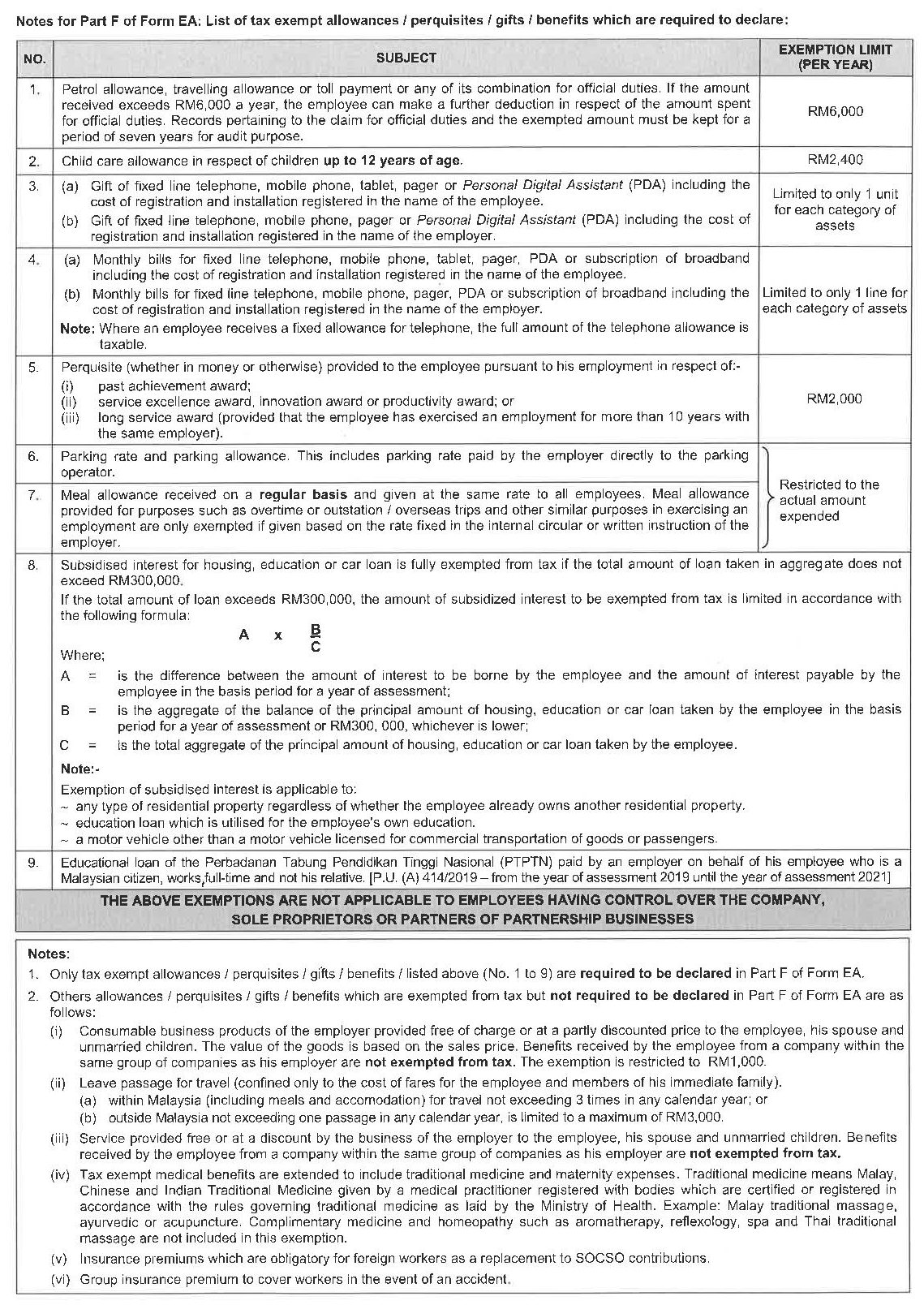

Part F:Total Tax exempted allowance / perquisites/gift/benefit (免税津贴/额外现金奖赏/礼物/福利总额)

In Part F please fill in all exempted benefit, perquisites, gift and benefit which are exempted.

The date of EA Form should be any date before end of February of subsequent year, for example Form E for year 2019 (remuneration received during 1.1.2019 to 31.12.2019), the EA form date should be on and before 29.2.2020。

雇主过去一年提供给员工的8种免税津贴、额外现金奖赏、礼物和福利总额,必须注明在此栏。

注意:EA Form 的日期应该放二月未,比如说2019的EA Form (2019年一月到12月的员工收入), EA form的日期是29.2.2020 或之前的日期.

List of tax exempted allowance / perquisites / gifts / benefits which are require to declare in Part F: