How to Submit Form E and Form CP8D To LHDN Via MyTax Portal

What is Form E?

Form E is an annual declaration report that every employer must submit to the IRB, providing details on the number of employees and their income. The submission deadline via MyTax is 30th April each year.

What is CP8D?

Form CP8D is a declaration report that includes details of the employer’s company and a comprehensive list of remuneration paid to each employee within a calendar year (January to December).

The deadline for submitting Form CP8D and Form E via e-Filing is 30th April each year. For example, remuneration received in 2023 must be reported by 30th April 2024, while remuneration received in 2024 must be reported by 30th April 2025. It is important to note that all companies, regardless of their activity status—whether dormant, inactive, or actively conducting business—are required to file both Form E and Form CP8D with LHDN.

My company is dormant (not in business) and has no employees. Do I still need to submit the forms?

Yes, submission is mandatory. Upon incorporation in Malaysia, your company is automatically assigned a tax number (C number) and an employer number (E number). All companies, regardless of activity status, must file Form E and Form CP8D using their employer number (E number).

Note: A director is considered a staff member of the company, even if the company is inactive.

When Should I Submit Form E and Form CP8D If My Accounting Year-End is Not in December?

Regardless of your accounting year-end, employer reporting for tax purposes—via Form E and Form CP8D—is based on the calendar year (January to December). This means that even if your company’s financial year-end falls in March, June, or any other month, you must still report employee-related tax details for the full calendar year.

The submission deadline remains 30th April of the following year.

Example:

If your company’s financial year ends on 30th June 2024, your Form E and CP8D for the 2024 calendar year (January–December 2024) must still be submitted by 30th April 2025.

________________________________________________________________________________________________________

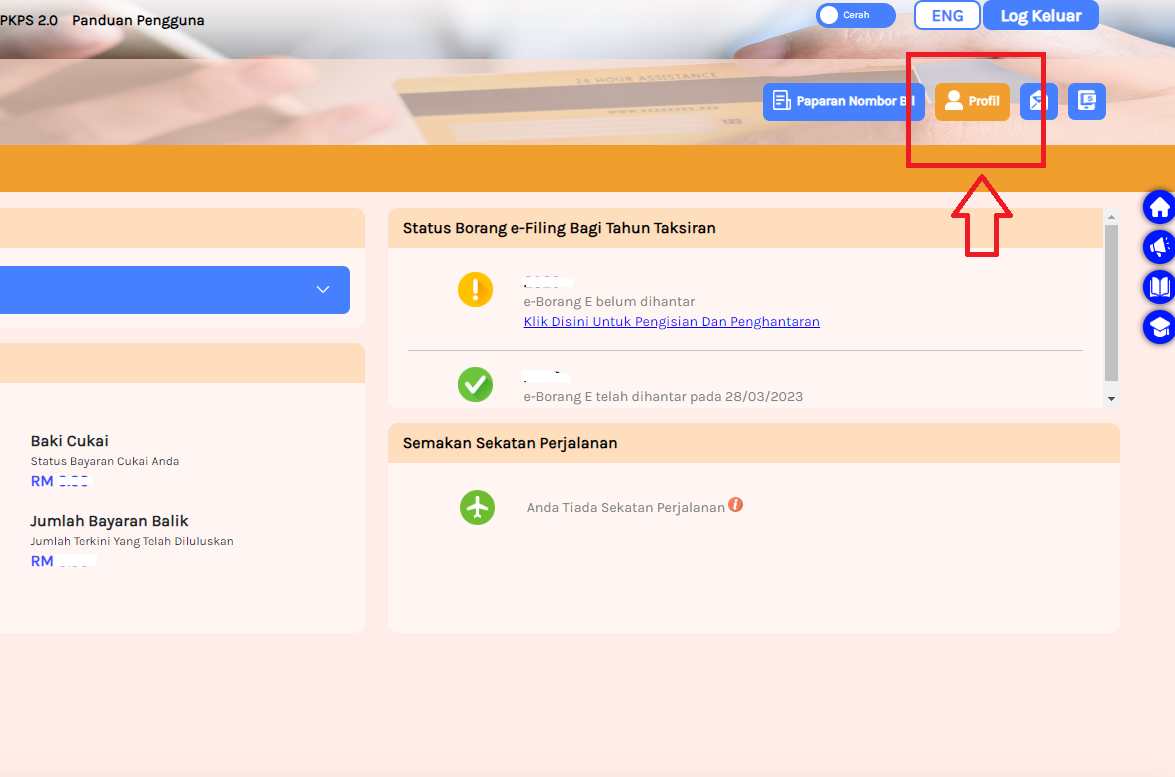

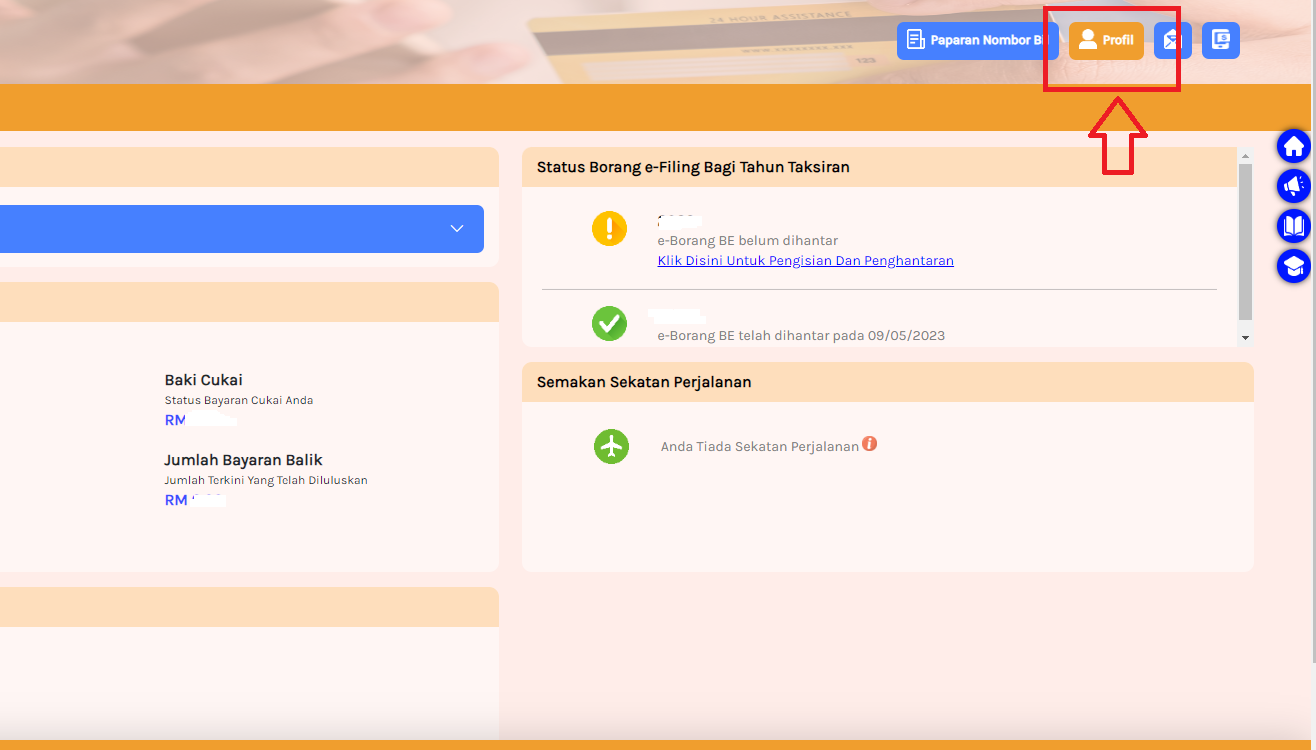

Step 5 – Click on the ‘Profile’ icon.

____________________________________________________________________________

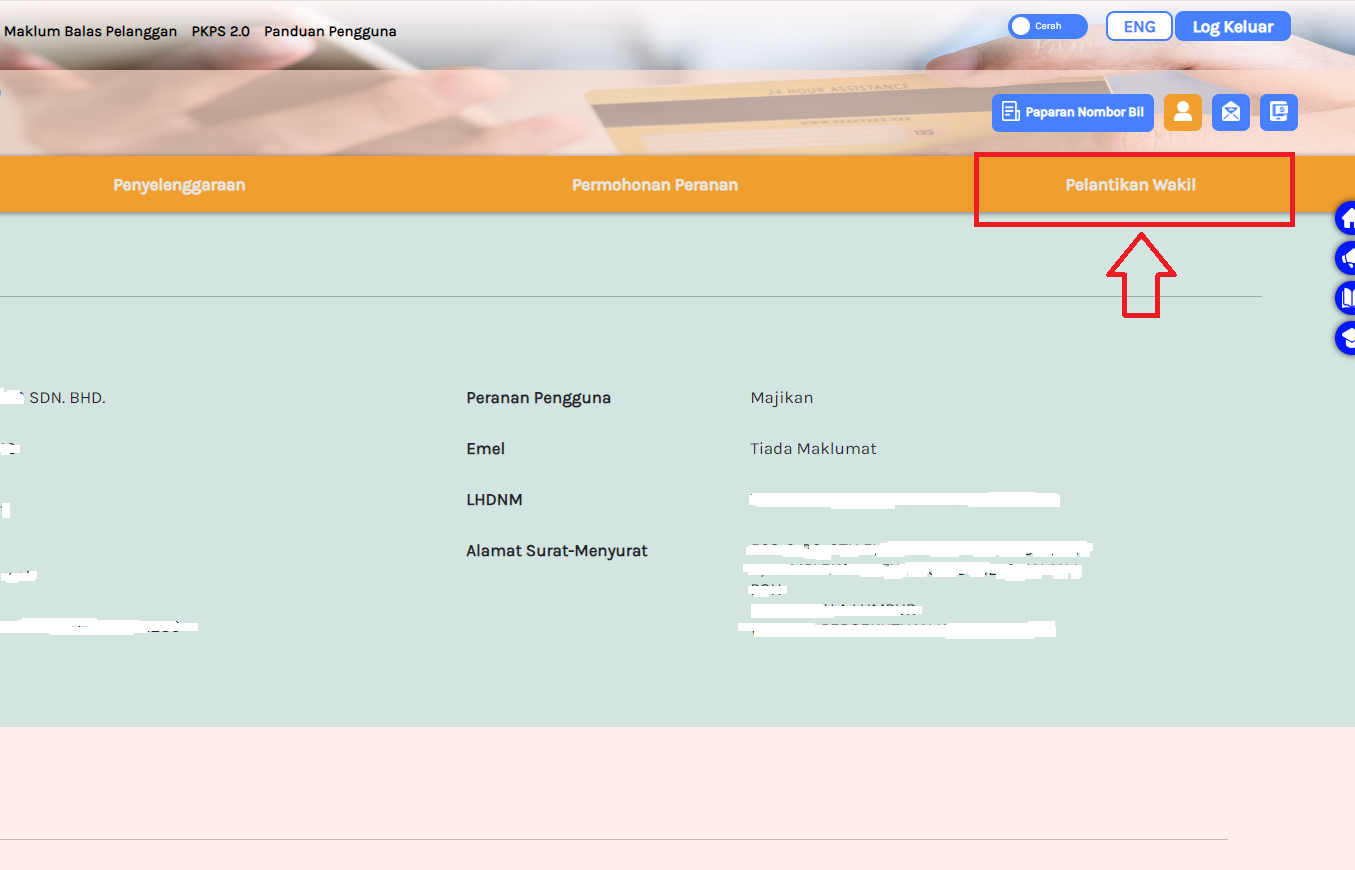

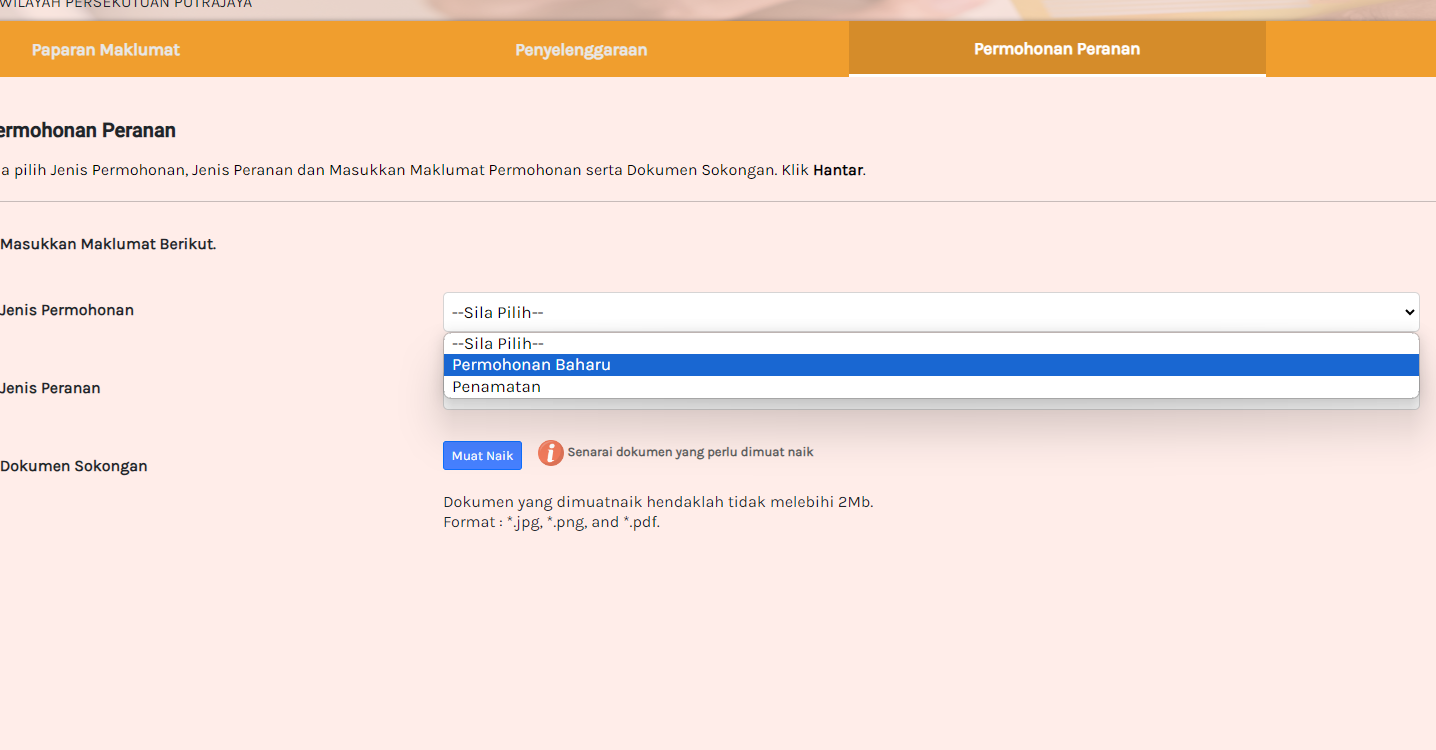

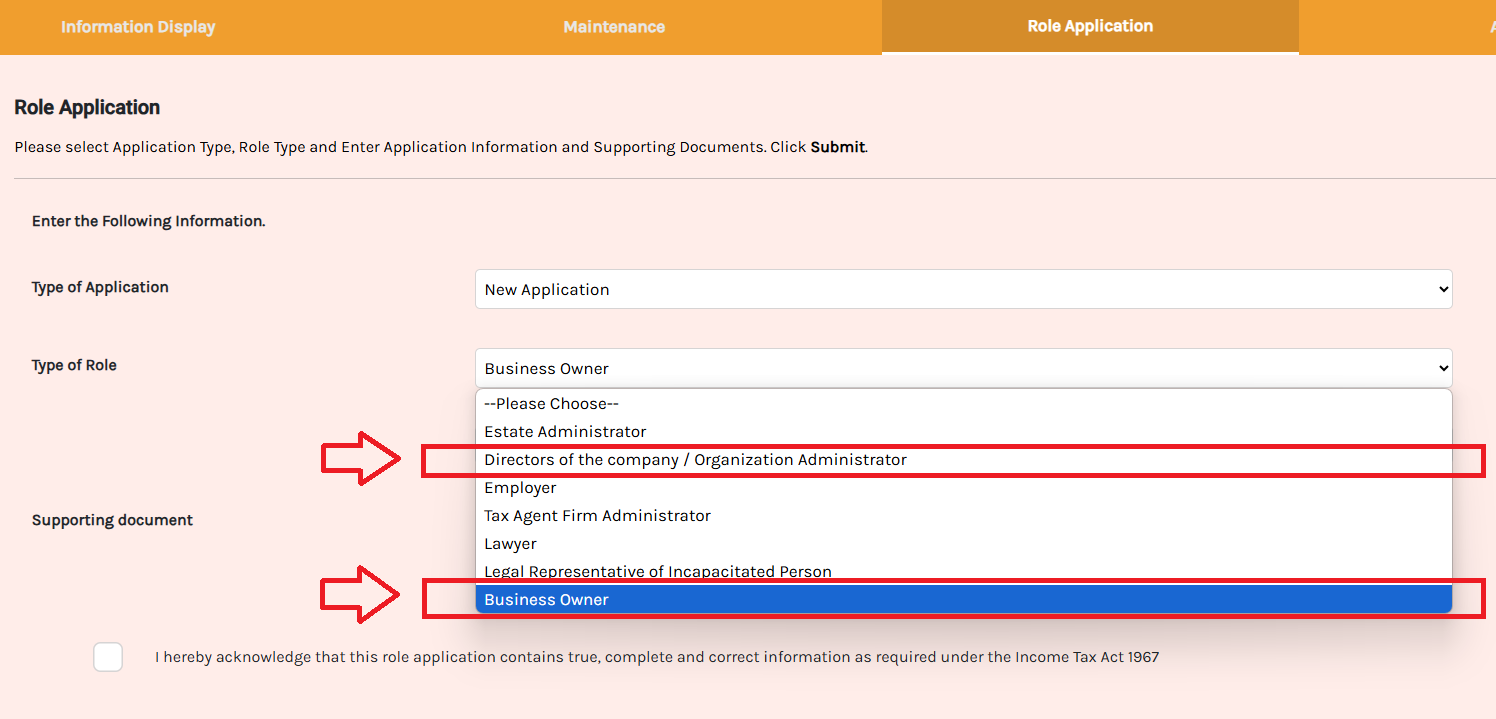

How to Link a Company (Employer) to the Director’s Personal MyTax Portal?

This process is essential if you are filing on behalf of your company as a director for the first time. You must link your personal MyTax account to your company by adding the company under your director capacity.

Step 1 – Click on profile icon

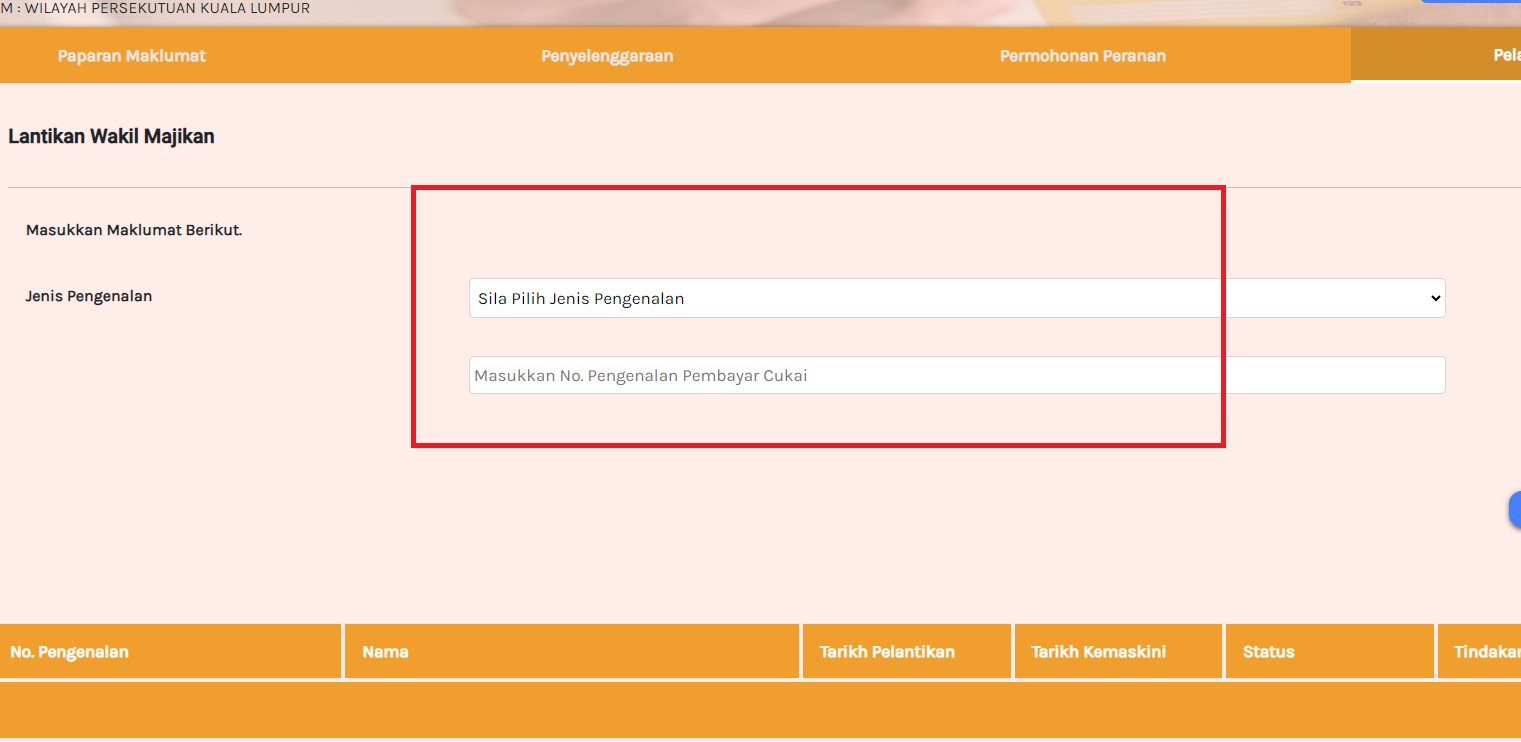

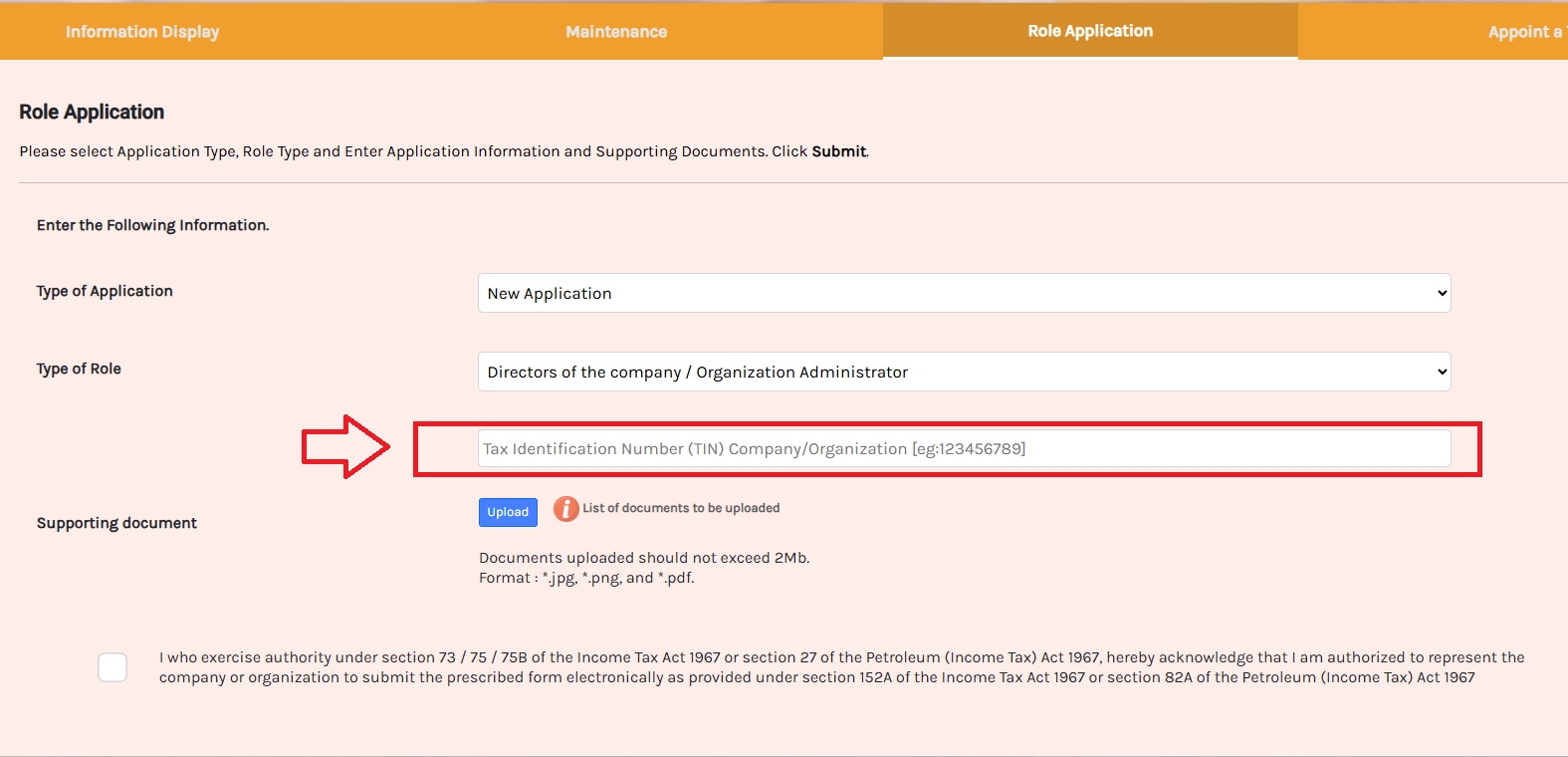

Step 5 – Enter your company’s Tax Identification Number (TIN) in the designated field.

-

If you do not have the TIN number, please contact LHDN to obtain it or check with your tax agent or company secretary to see if they have it on record.

-

Once you have added yourself as a director in MyTax under your company, you will automatically be granted access to the Employer page of your company.

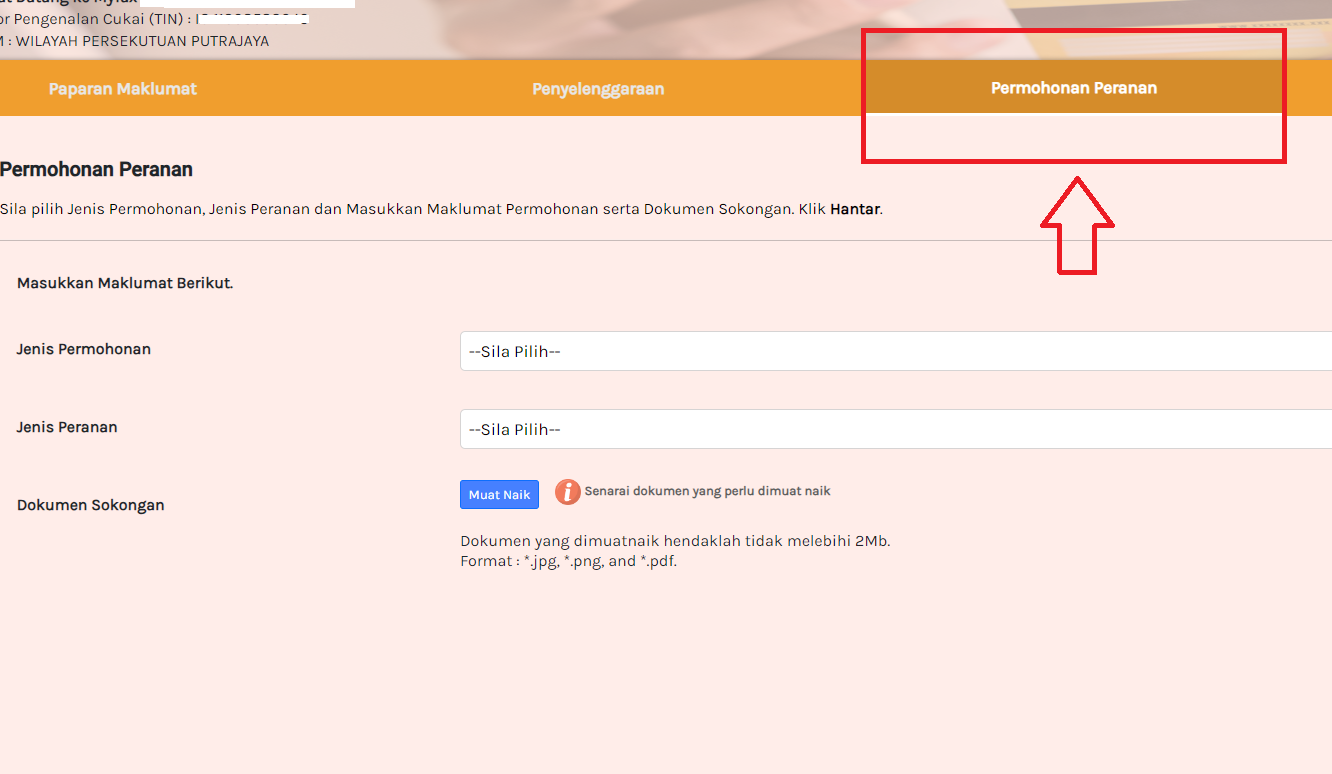

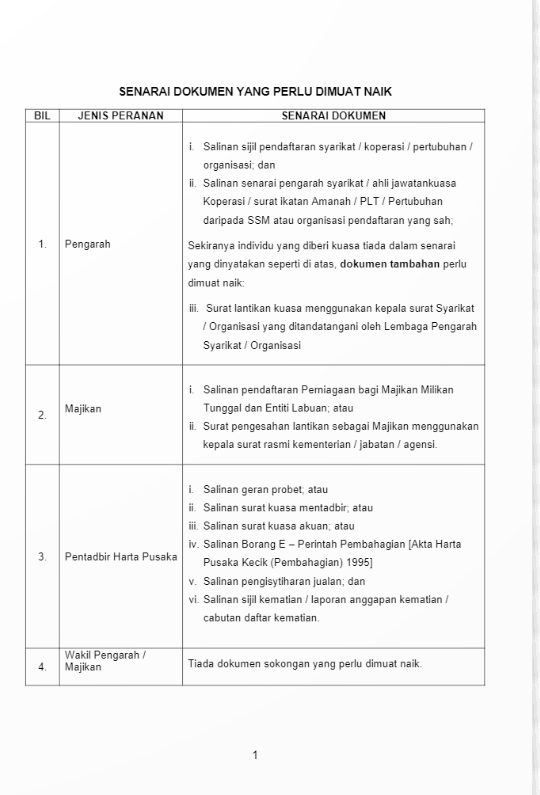

Next, upload the SSM document.

You may refer below for the document required:

Step 7 – Tick the acknowledgment box, click Submit, and wait for approval from LHDN.

This completes the process.

_____________________________________________________________________________________________________________________

Before proceeding to submit Form E, you need to file Form CP8D.

Let start with Form CP8D

_______________________________________________________________________

How to Submit form CP8D using Mytax portal?

Step 1 – Log on to Mytax Portal

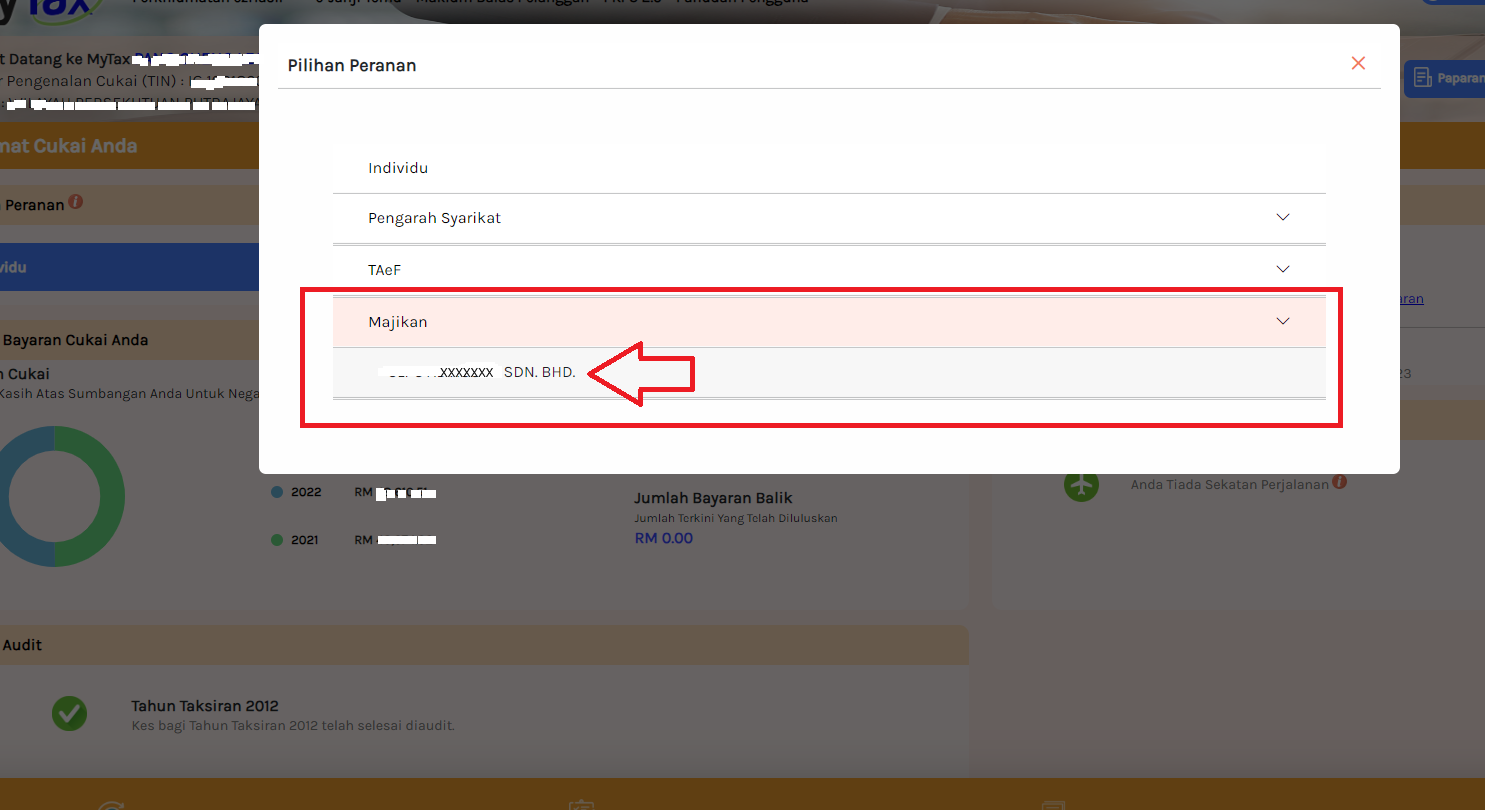

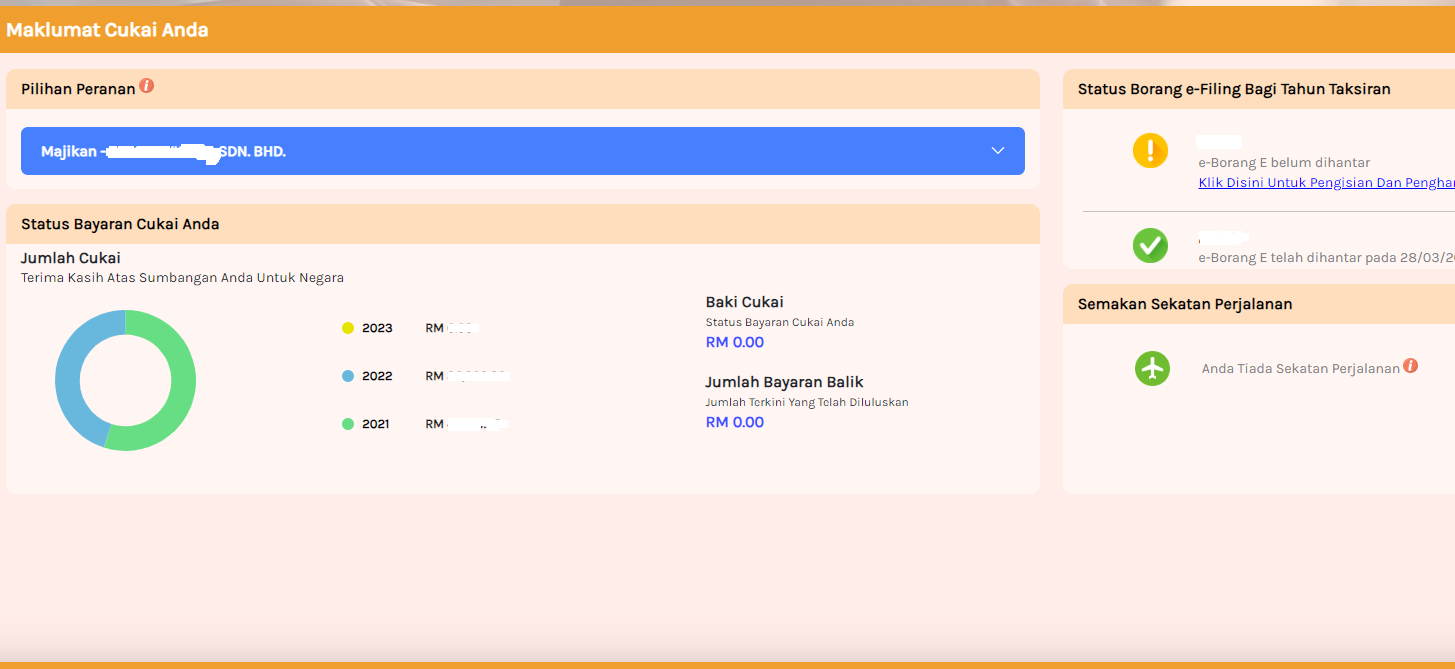

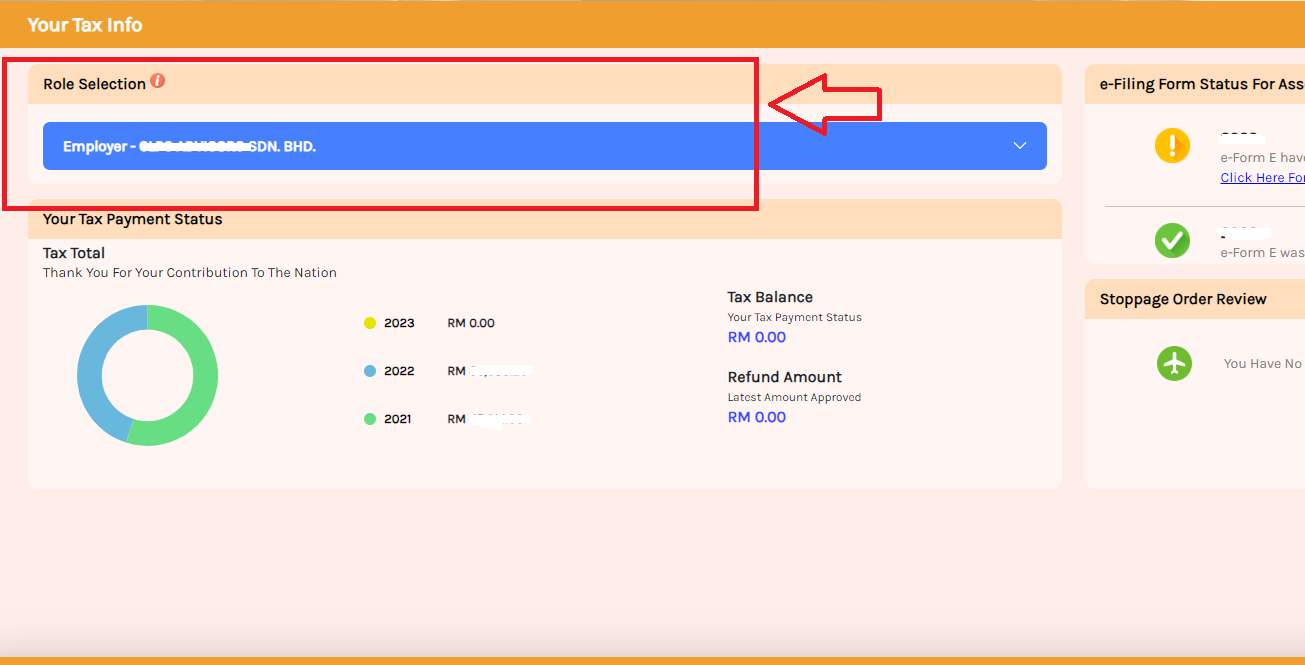

Step 2 – Go to role Selection, choose Employer (majikan)

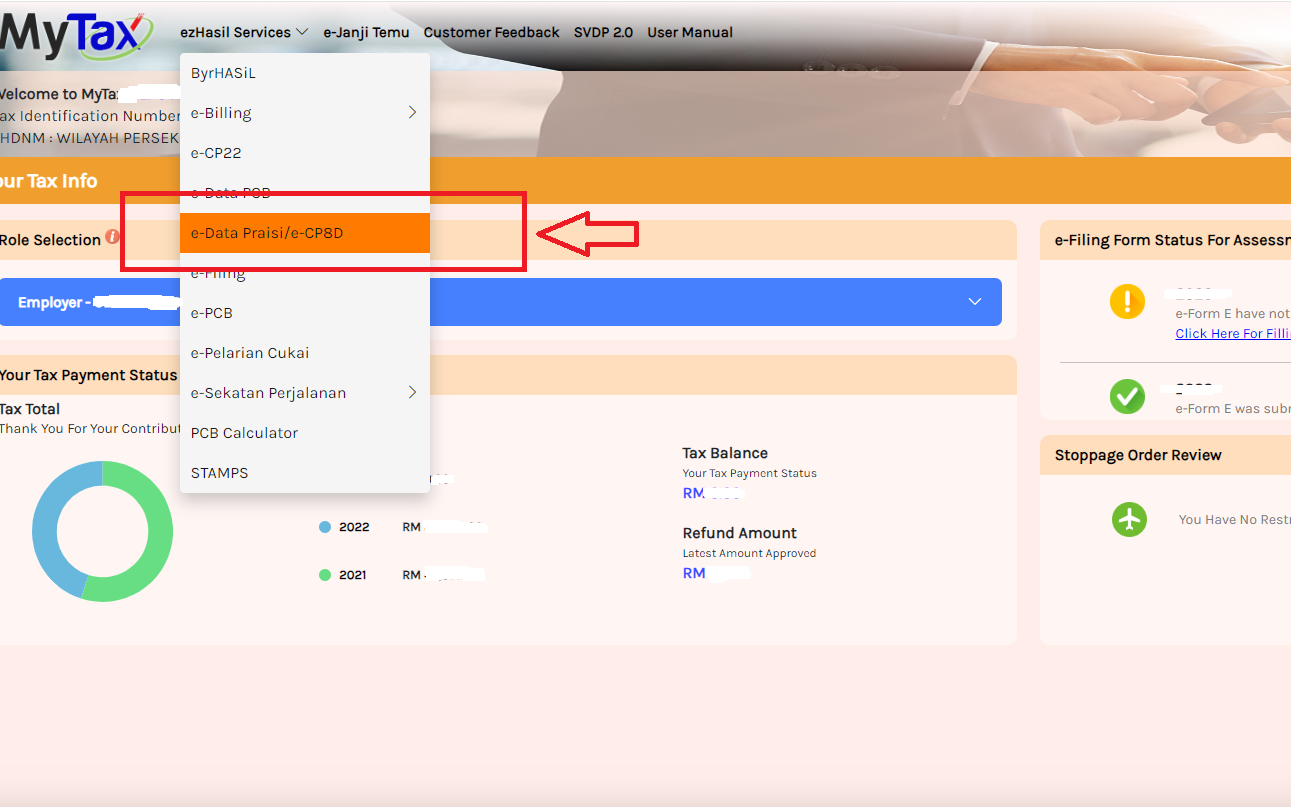

Step 3 – Click on EzHasil Services, then from the dropdown menu, select E-Data Pra-isi / e-CP8D.

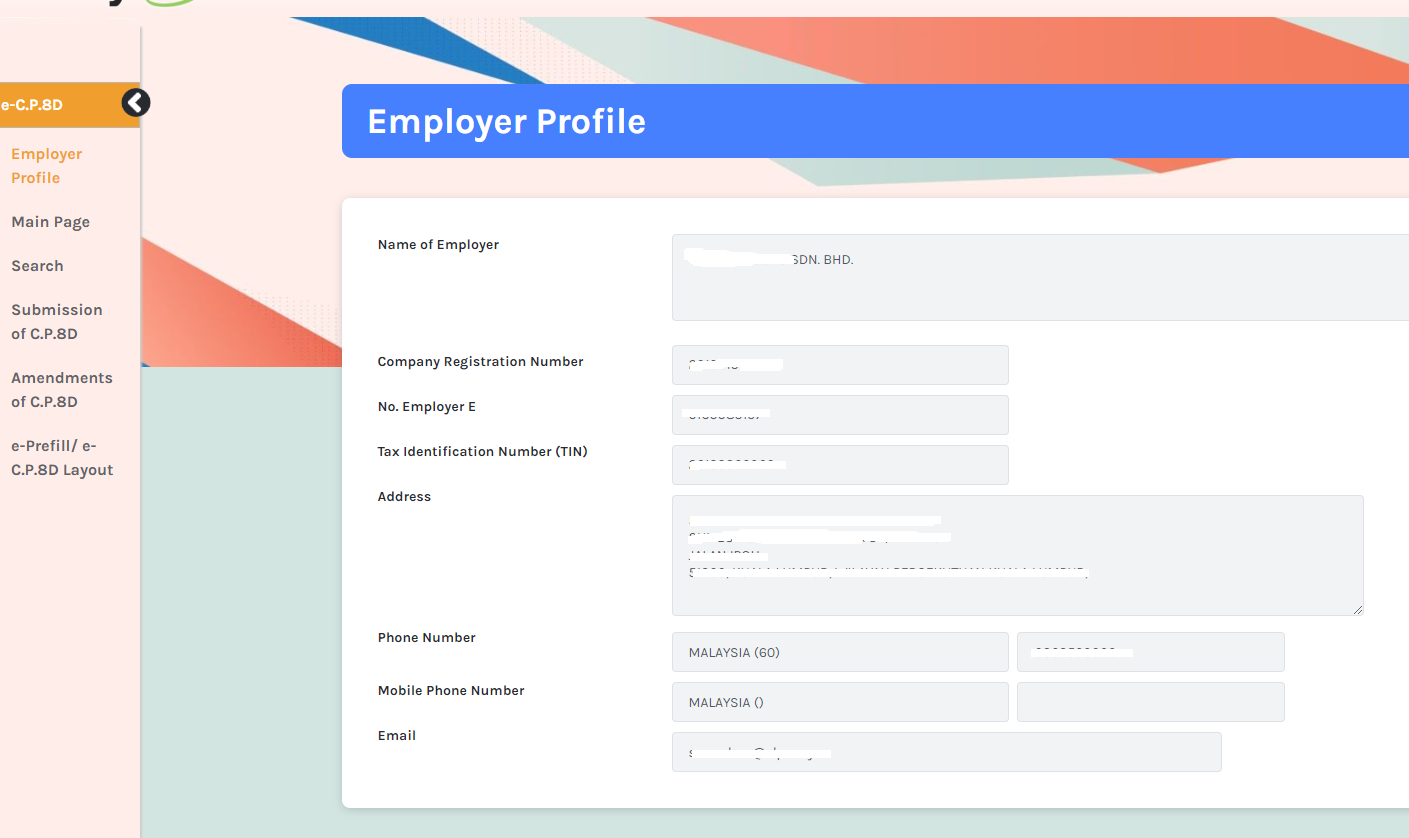

Step 4 – Your company’s Employer page will appear. Please review your company details.

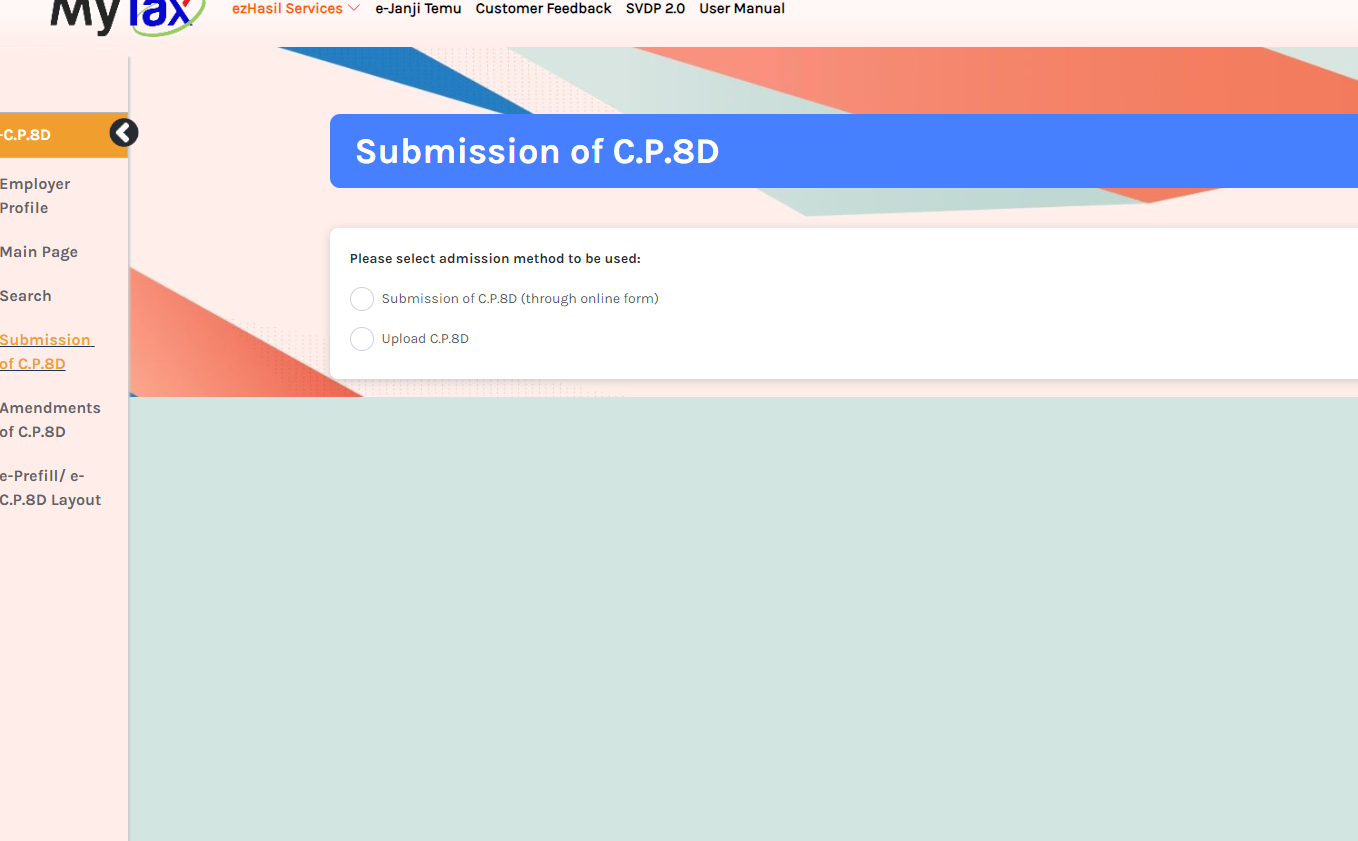

Step 5 – On the left-hand sidebar, select “Submission of CP8D.”

There are two submission options available:

-

Submission of CP8D (Through Online Form) – Select this option if you are not using payroll software. You will need to manually enter employee (including director) information and remuneration details one by one.

-

Upload CP8D – Select this option if you are using payroll software to generate CP8D or Data Pra-isi. Simply upload the data downloaded from your payroll software.

For this guide, we assume you have selected “Submission of CP8D (Through Online Form).”

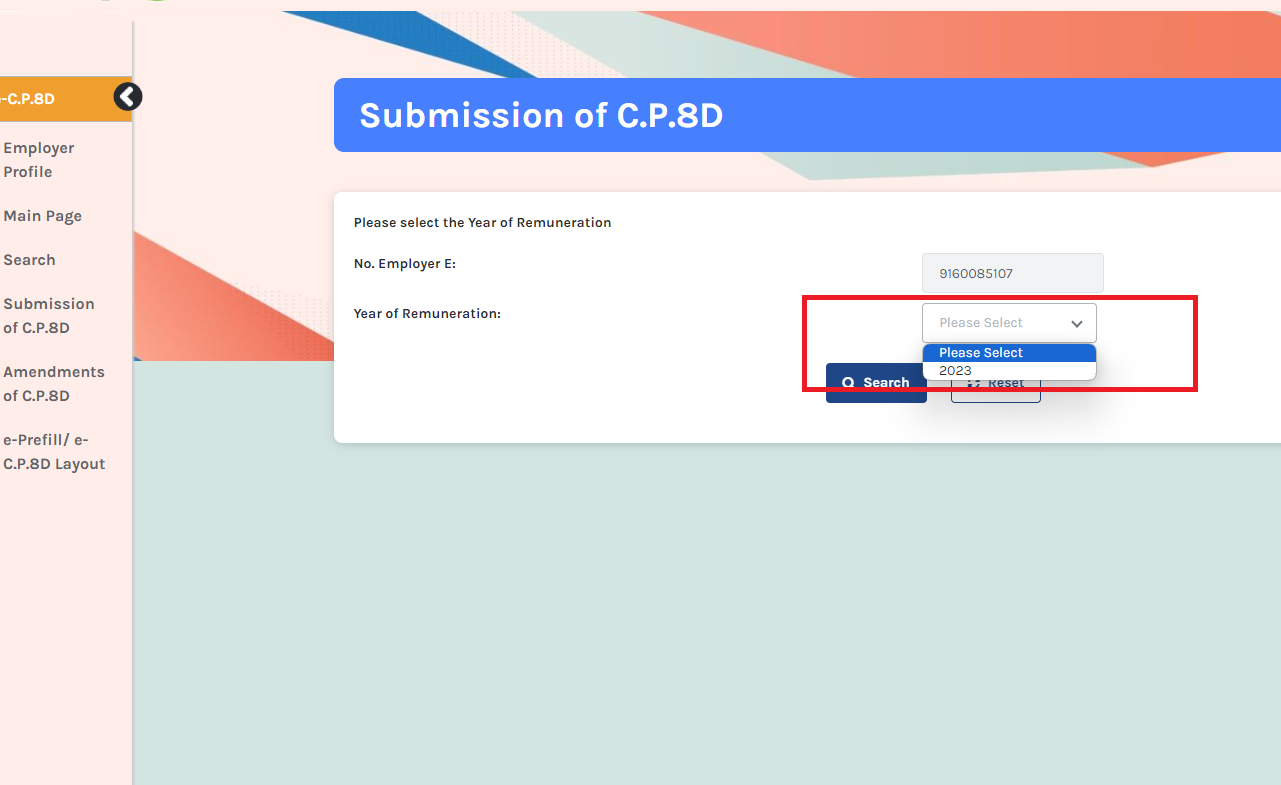

Step 6 – From the dropdown menu, select the year of remuneration you wish to submit, then click Search.

For illustration purposes, we will use year 2023 as an example:

-

If you are submitting CP8D for Remuneration 2023 (due by 30th April 2024), this refers to the total salary, fees, commission, perquisites, and benefits-in-kind (BIK) received by employees (including directors) during the calendar year 1.1.2023 – 31.12.2023.

-

If you are submitting CP8D for Remuneration 2024 (due by 30th April 2025), this refers to the total salary, fees, commission, perquisites, and benefits-in-kind (BIK) received by employees (including directors) during the calendar year 1.1.2024 – 31.12.2024.

Step 7 – Form CP8D will appear on the screen. You can now search for or manually enter your company’s employee remuneration details, including those of directors.

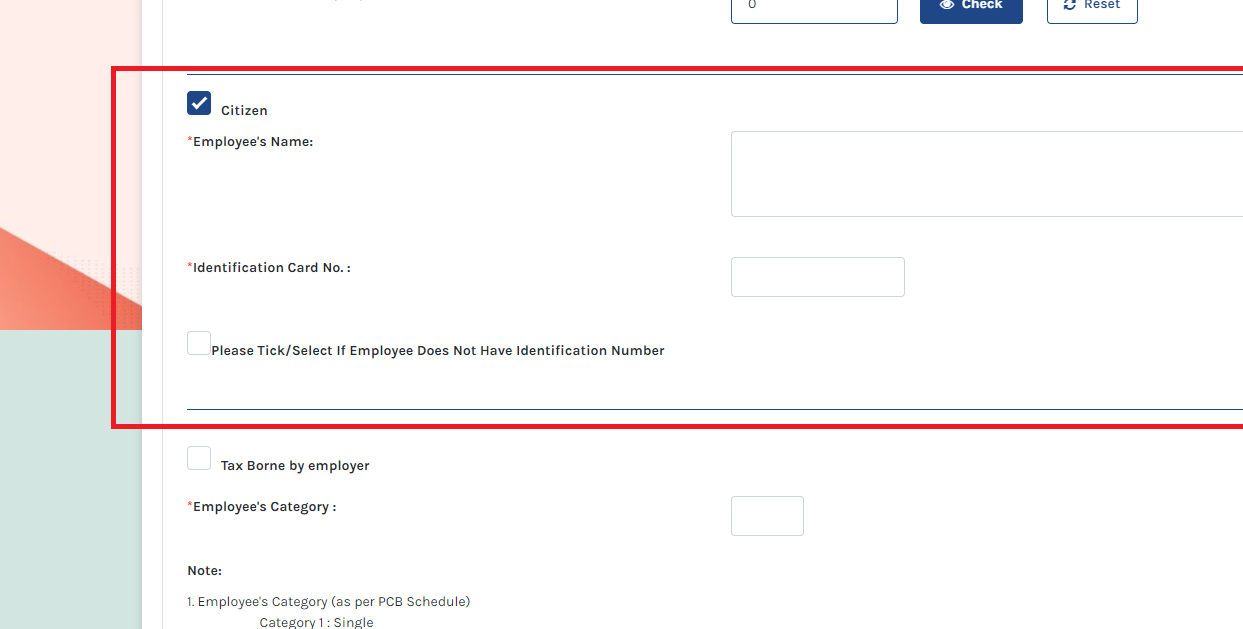

Step 8 – tick on citizen if employee is a Malaysia citizen, type-in name and NRIC

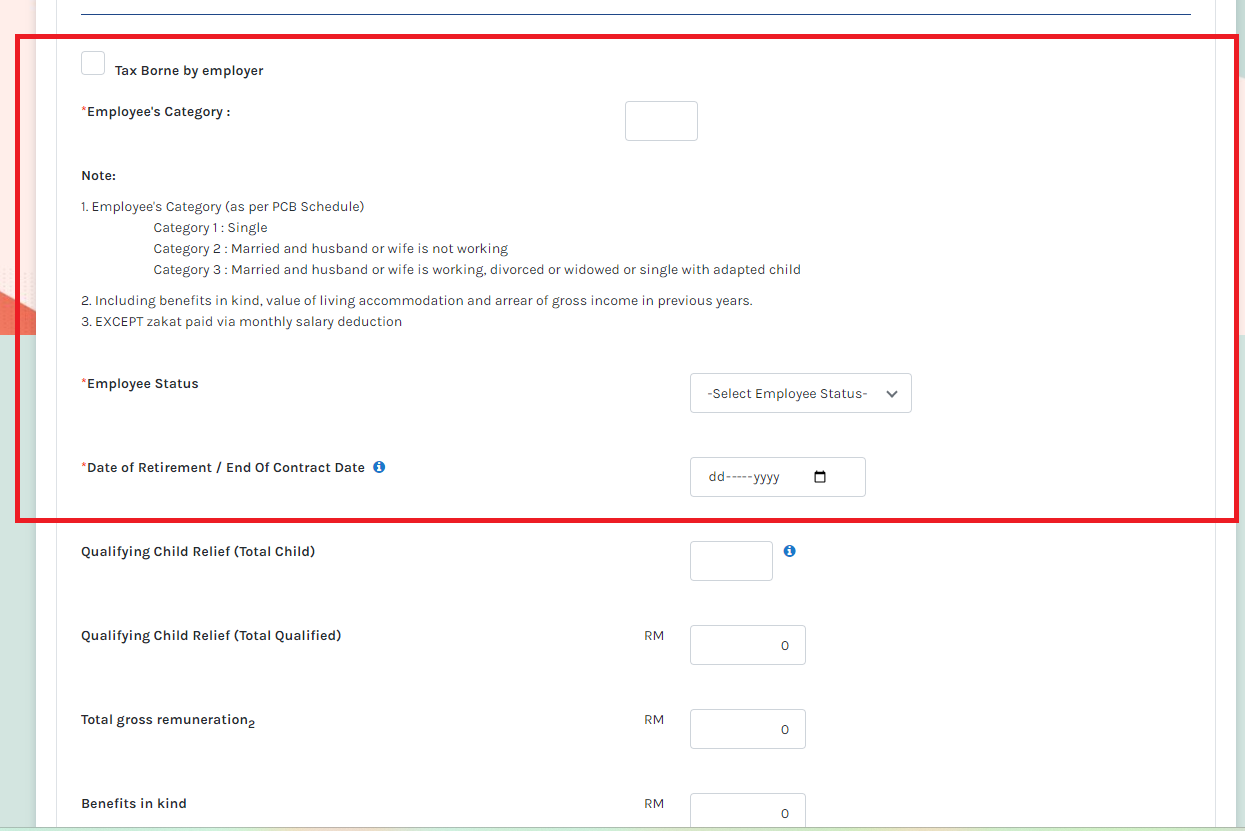

Step 9 – Enter the required details, including employee category, employee status, and date of retirement, into the system.

Key Fields to Complete:

-

Tax Borne by Employer:

-

If the employer pays the employee’s personal income tax, it is considered a taxable benefit and must be declared in Form EA and reported in Form CP8D.

-

If your company does not pay personal income tax for employees, select “No.”

-

-

Employee Category (Select one):

-

Single

-

Married, and spouse is not working

-

Married, and spouse is working

-

Divorced/Widowed/Single with adopted child

-

-

Date of Retirement:

-

If your company has a compulsory retirement age stated in its handbook or policy, calculate and provide the date accordingly.

-

If there is no specific policy, use the statutory retirement age of 60 to determine the date.

-

-

Qualifying Child Relief:

-

Enter the number of children eligible for tax relief and the total child relief amount (in RM).

-

-

Total Gross Remuneration:

-

This includes salary, overtime, commission, allowances, and director’s fees received or receivable as per Form EA.

-

-

Benefit in Kind (BIK):

-

BIK refers to benefits provided by the company to employees, such as:

-

A company car used by an employee/director for both business and personal purposes.

-

Petrol claims reimbursed for both business and personal use.

-

-

For more information on BIK and how to determine its value, you may refer to the following link:

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_11_2019.pdf

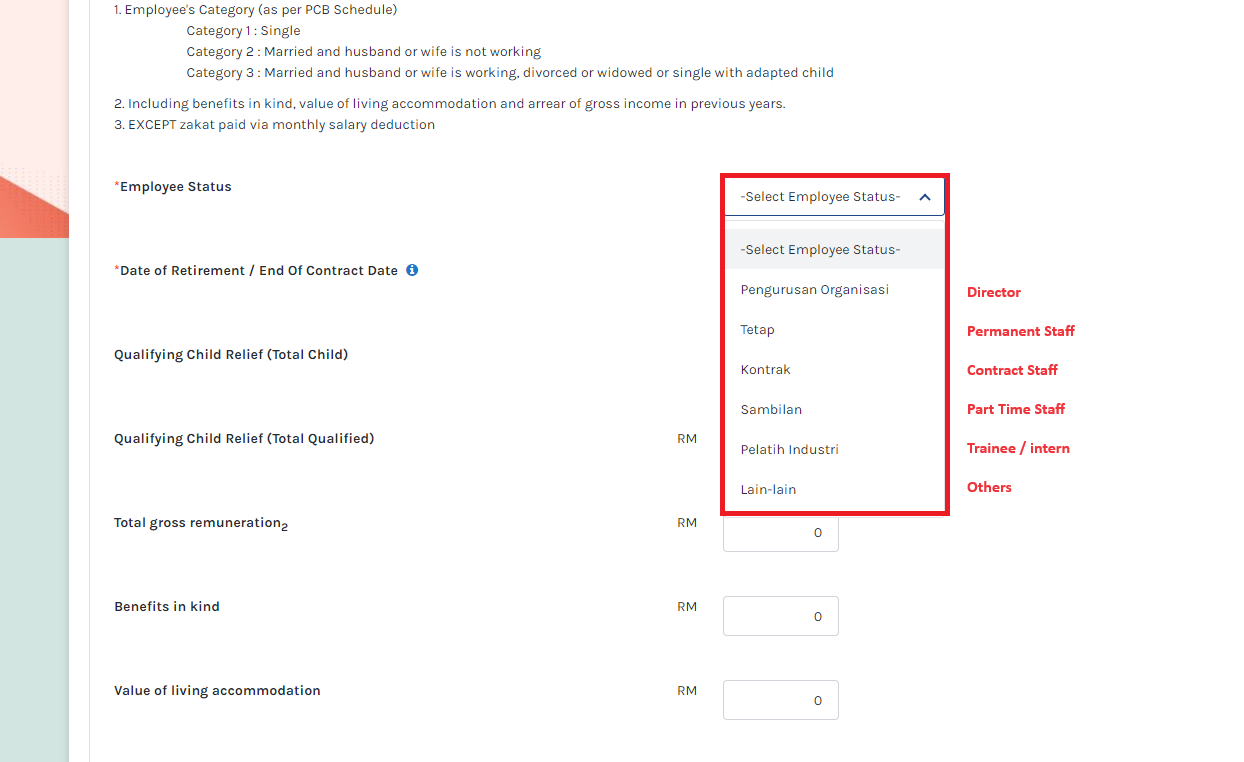

Step 10 – Select Employee Status & Enter the Value of Living Accommodation (VOLA) (if applicable).

1) Select Employee Status:

-

Pengurusan Organisasi = Director

-

Tetap = Permanent Staff

-

Kontrak = Contract Staff

-

Sambilan = Part-Time Staff

-

Pelatih Industri = Trainee/Intern

-

Lain-lain = Others

2) Enter ‘Value of Living Accommodation’ (VOLA)

If the company provides living accommodation to an employee (including a director), the Value of Living Accommodation (VOLA) is considered a taxable benefit for the employee. The company must declare this benefit in Form EA and report it in Form CP8D.

To understand how VOLA is determined, please refer to the following link: [Insert link here].

https://phl.hasil.gov.my/pdf/pdfam/PR3_2005.pdf

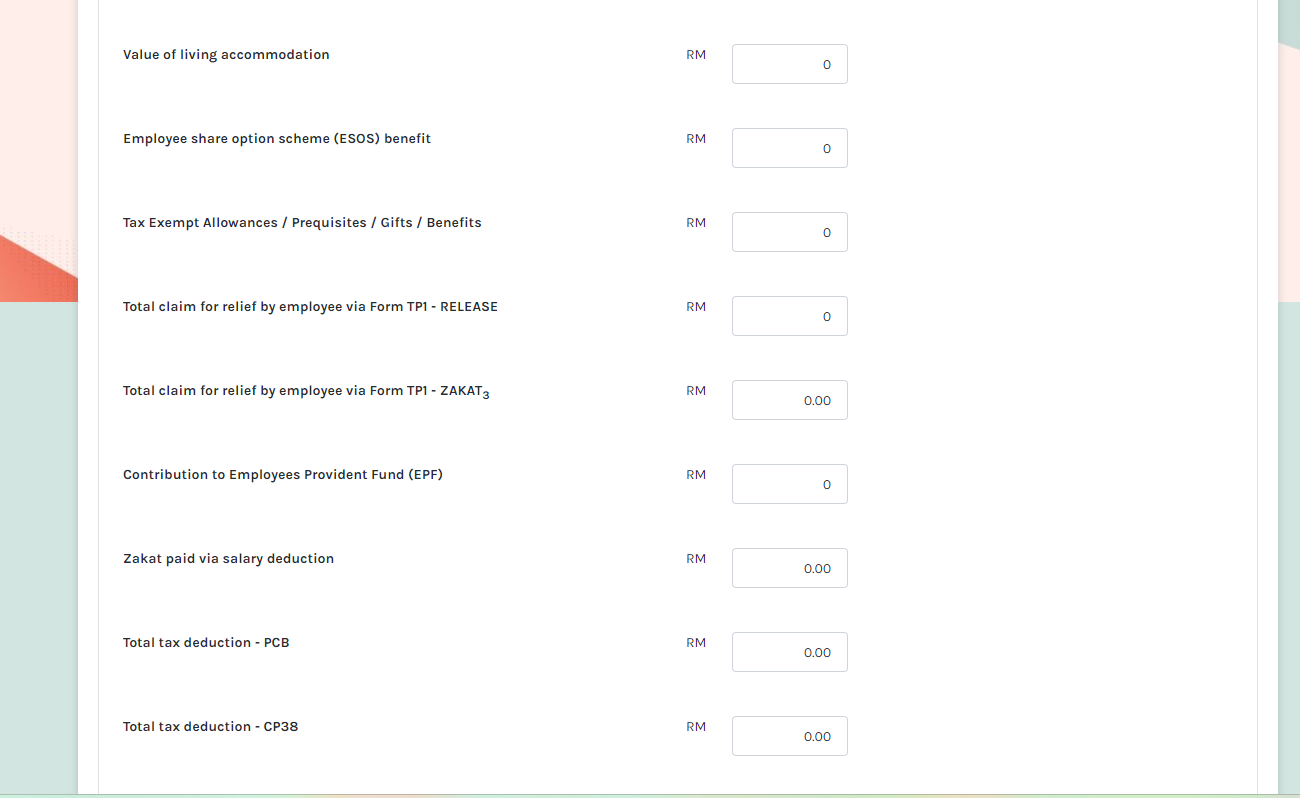

Step 11 – Continue entering additional employee information.

Key Fields to Complete:

-

Employee Share Option Scheme (ESOS) Benefit

-

If your company provides ESOS share benefits to employees, enter the value of the share benefit received.

-

-

Tax-Exempt Allowances / Perquisites / Gifts / Benefits

-

If your company has given an employee free gifts, perquisites, or other benefits, state the monetary value of these benefits.

-

-

Total Relief Claims by Employee (via Form TP1)

-

Enter the total amount of tax relief claimed by the employee through Form TP1.

-

-

EPF Contribution (Employee Portion)

-

Insert the employee’s share of EPF contributions deducted from their salary.

-

-

Zakat Deducted from Salary

-

Enter the amount of zakat deducted directly from the employee’s salary.

-

-

PCB Deducted from Salary (CP39, CP38)

-

Insert the total monthly tax deductions (PCB) made from the employee’s salary, including deductions under CP39 and CP38.

-

What is Prequisite?

Prequisite is a benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of

having or exercising an employment. To understand of the concept of Prequisite, please click on below:

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_05_2019.pdf

What is Form TP1?

The TP1 is an income tax form that is given to the employer by the employee to ensure that the MTD (monthly tax deductions) have taken into account the necessary rebates and deductions.

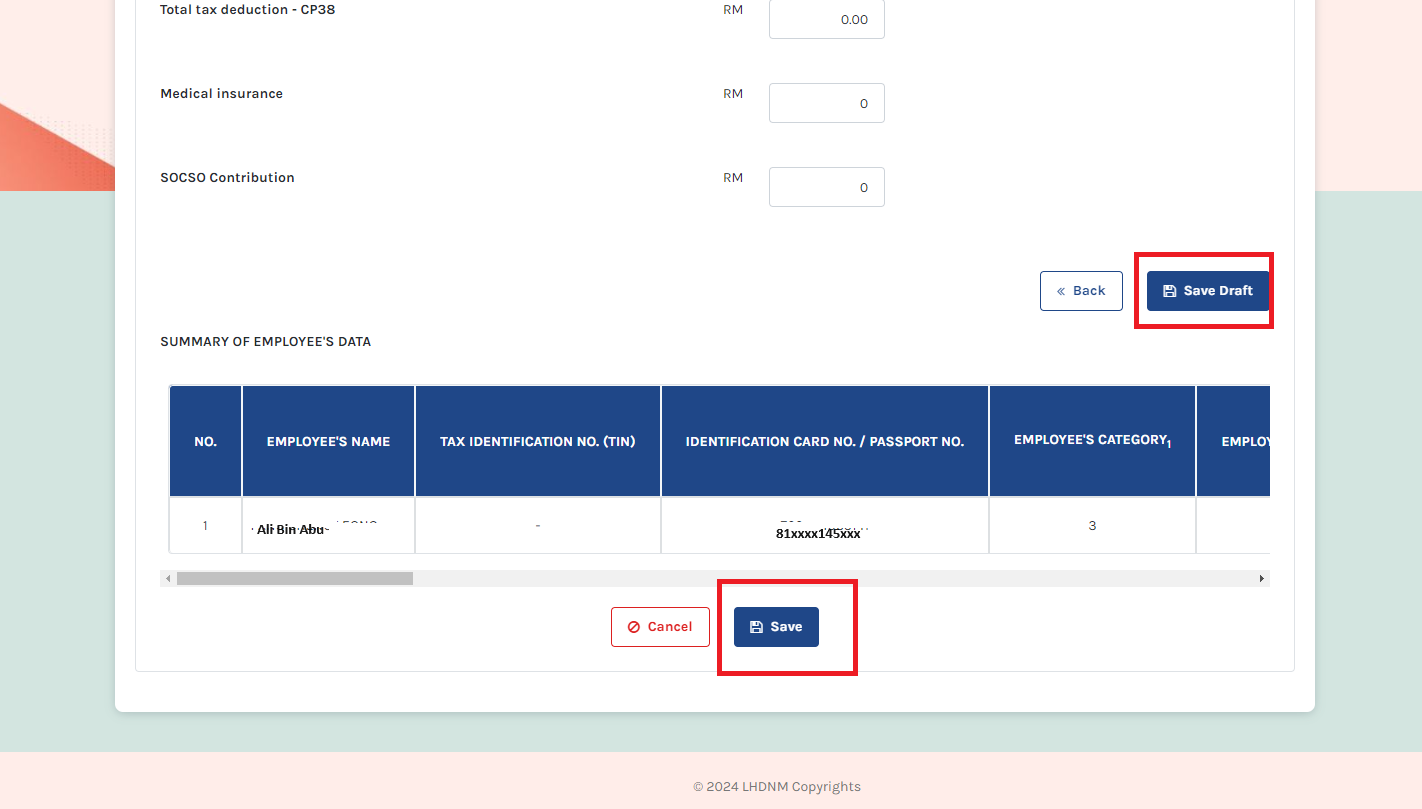

Step 12 – After completing the entries, make sure to click “Save Draft” first, then click “Save” to ensure all changes are properly recorded.

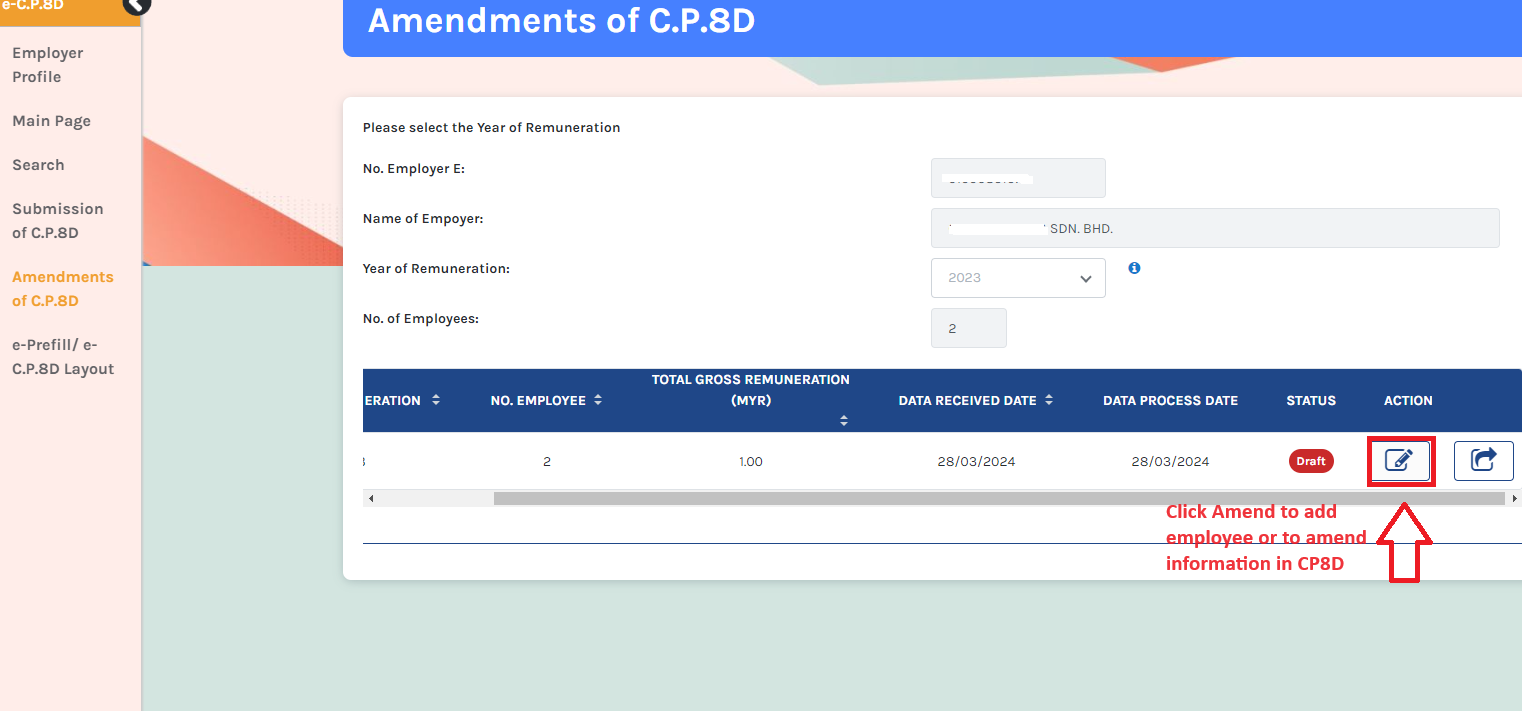

Step 13 – To add more employees, go to the “Amendment of CP8D” option in the left sidebar. Then, select the year of remuneration and click “Search.”

Step 14 – Click on the “Amend” button to either add a new employee or modify existing details in CP8D.

Step 15 – Once completed, click “Submit.”

Congratulations! You have successfully completed Form CP8D. You may now proceed to Form E.

——————————————————————————————————————————————————————————————————————-

How to submit form E using Mytax portal?

Step 1 – Log on to Mytax Portal

Step 2 – Navigate to ‘Role Selection’, choose Employer (majikan)

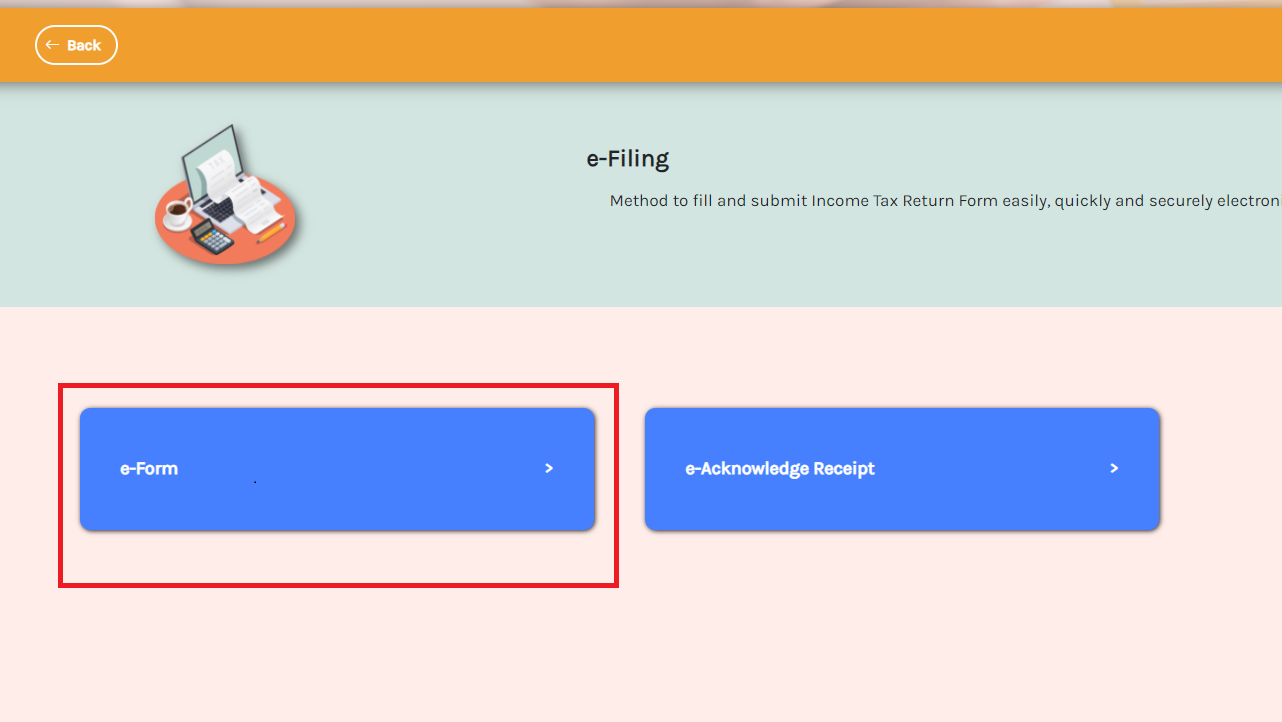

Step 3 – Navigate to the EzHasil Services dropdown menu and select ‘E-filing’

Step 4 – Select E-Form

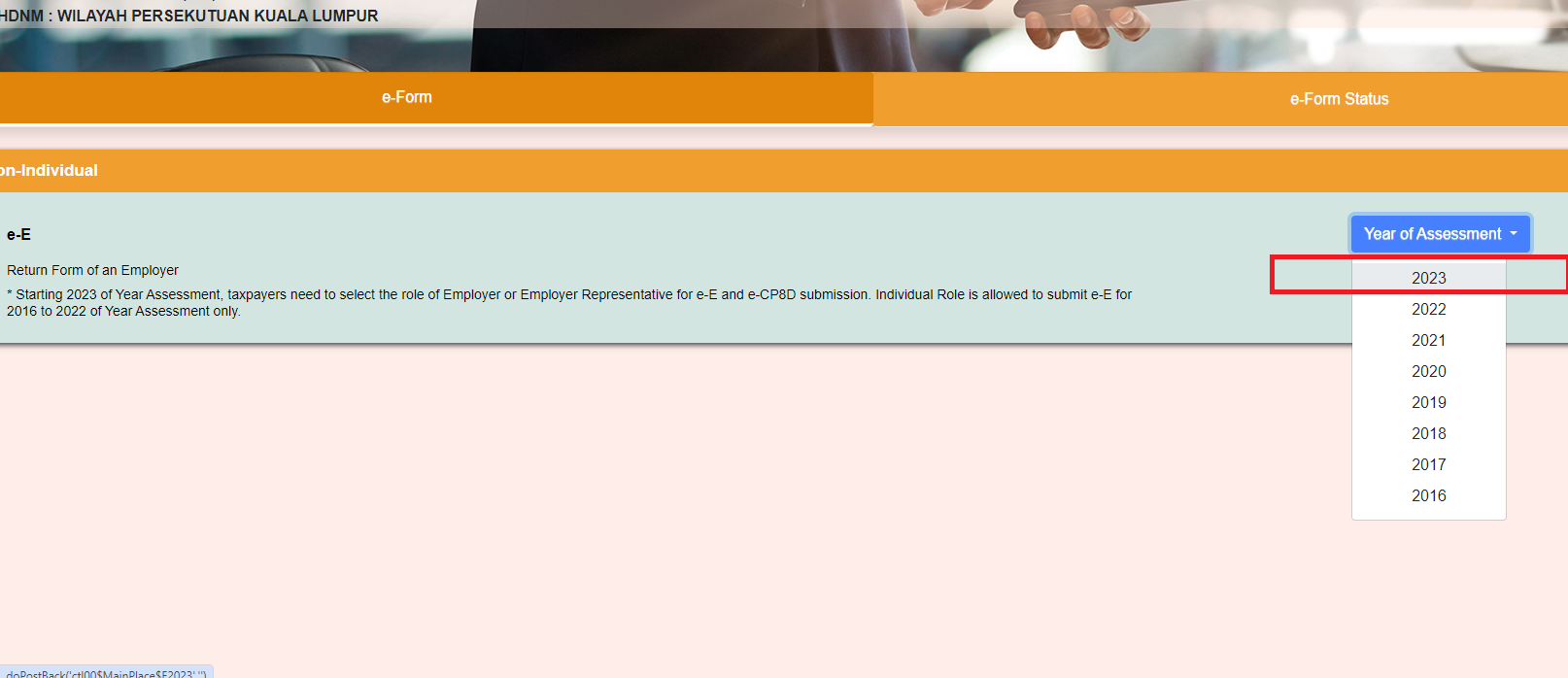

Step 5 – Select Form e-E and select the year you wish to submit

For illustration purposes, we will use year 2023 as an example:

-

If you are submitting Form E for Remuneration 2023 (due by 30th April 2024), this refers to the total salary, fees, commission, perquisites, and benefits-in-kind (BIK) received by employees (including directors) during the calendar year 1.1.2023 – 31.12.2023.

-

If you are submitting Form E for Remuneration 2024 (due by 30th April 2025), this refers to the total salary, fees, commission, perquisites, and benefits-in-kind (BIK) received by employees (including directors) during the calendar year 1.1.2024 – 31.12.2024.

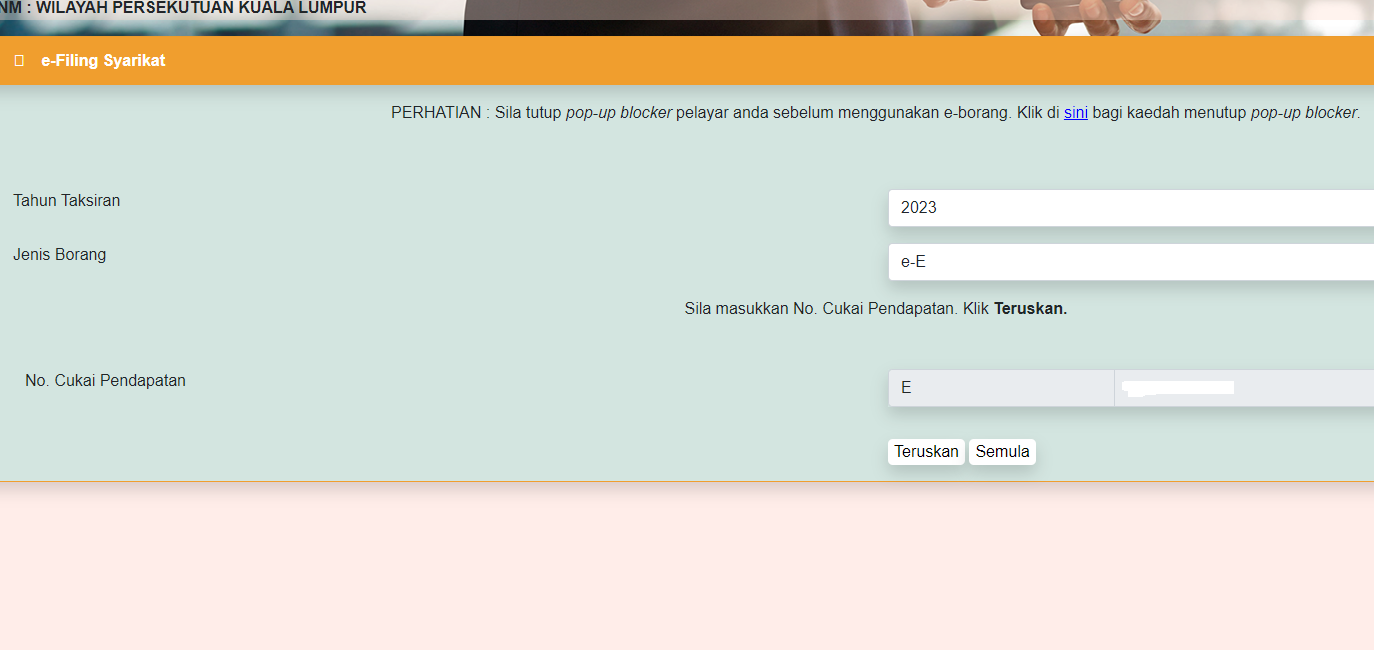

Step 6 – Your company’s E number will appear. Now, click “Teruskan” (Continue).

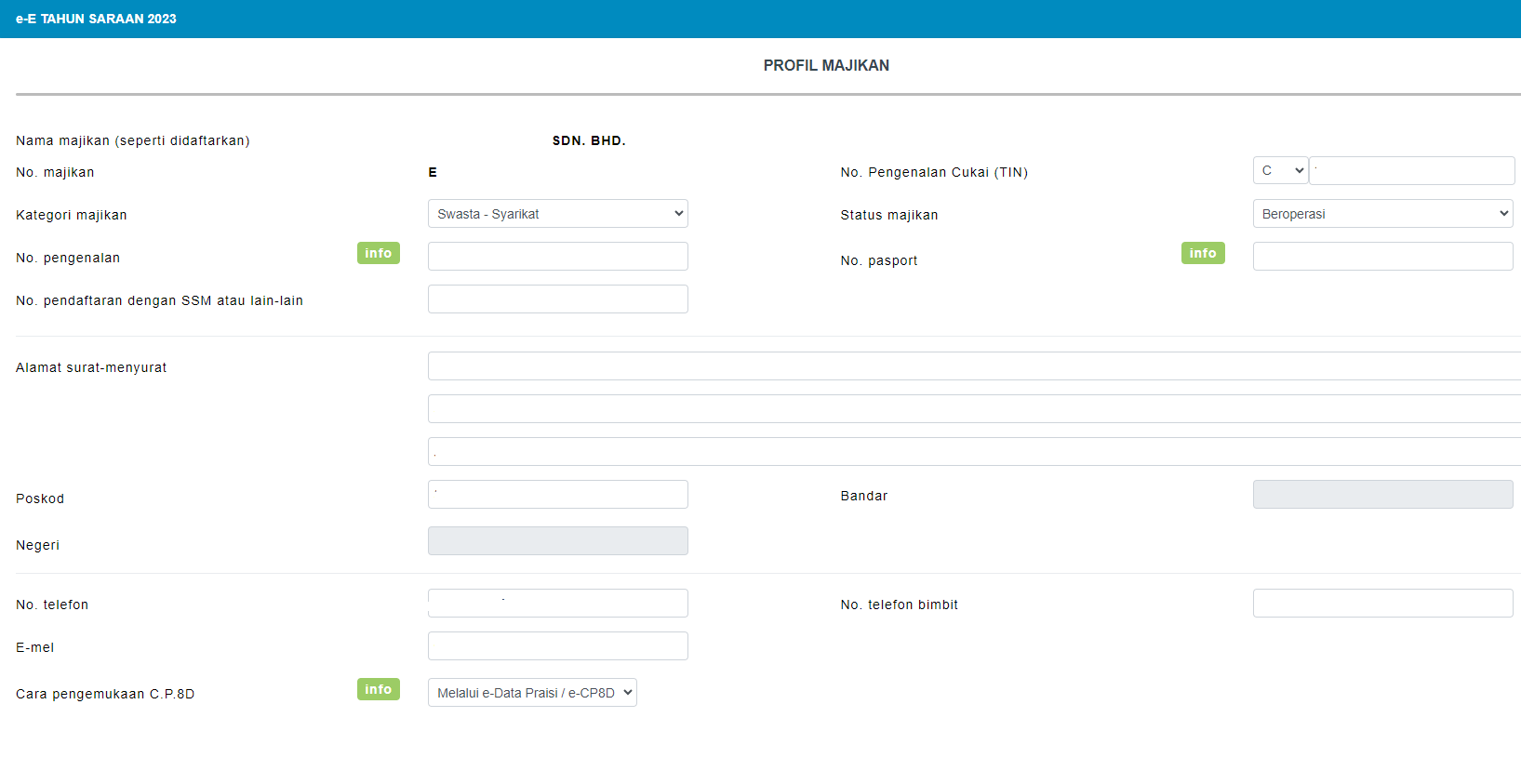

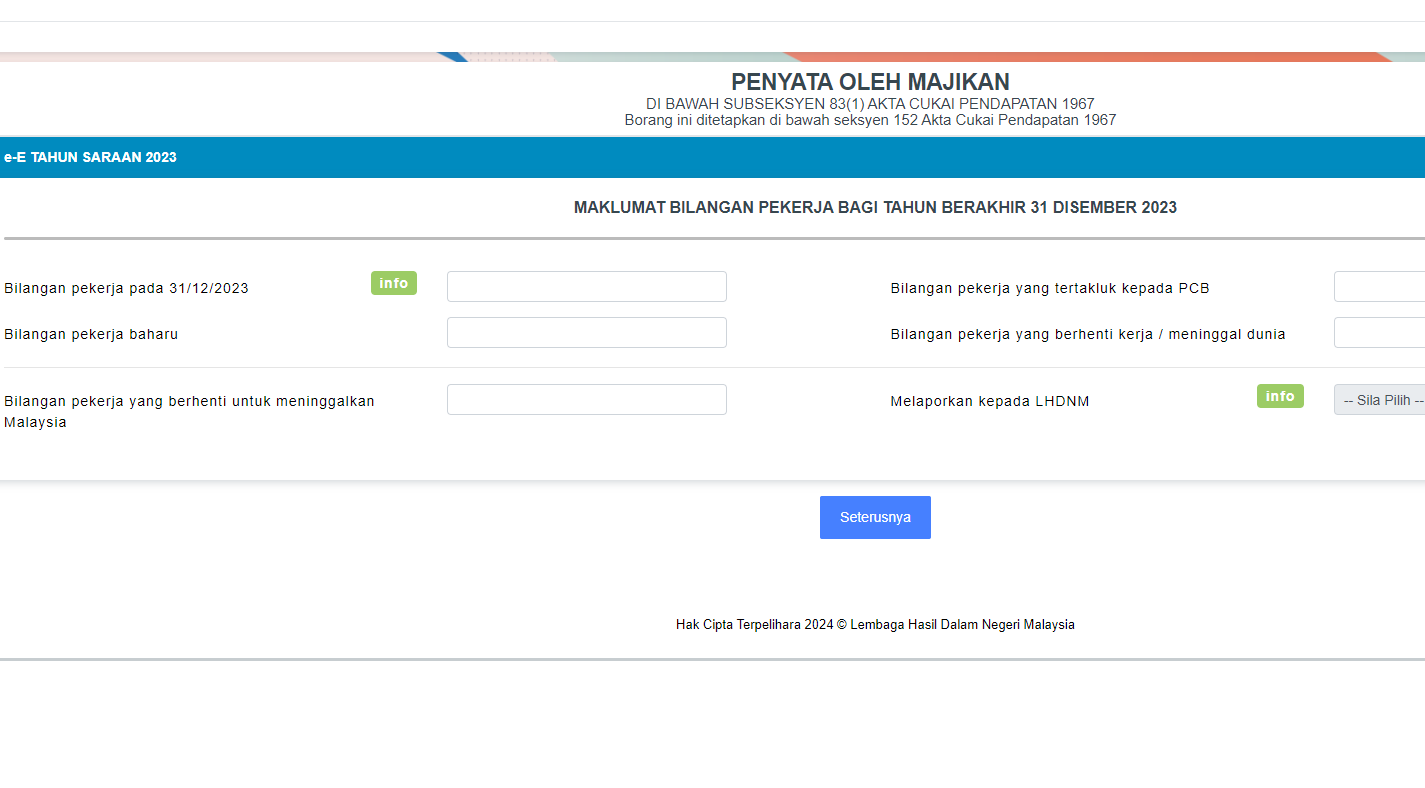

Step 7 – You will be directed to the Form E page, where you can review and enter the necessary information.

Step 8 – In the employer category column, select Company (swasta) if your company is a Sdn Bhd

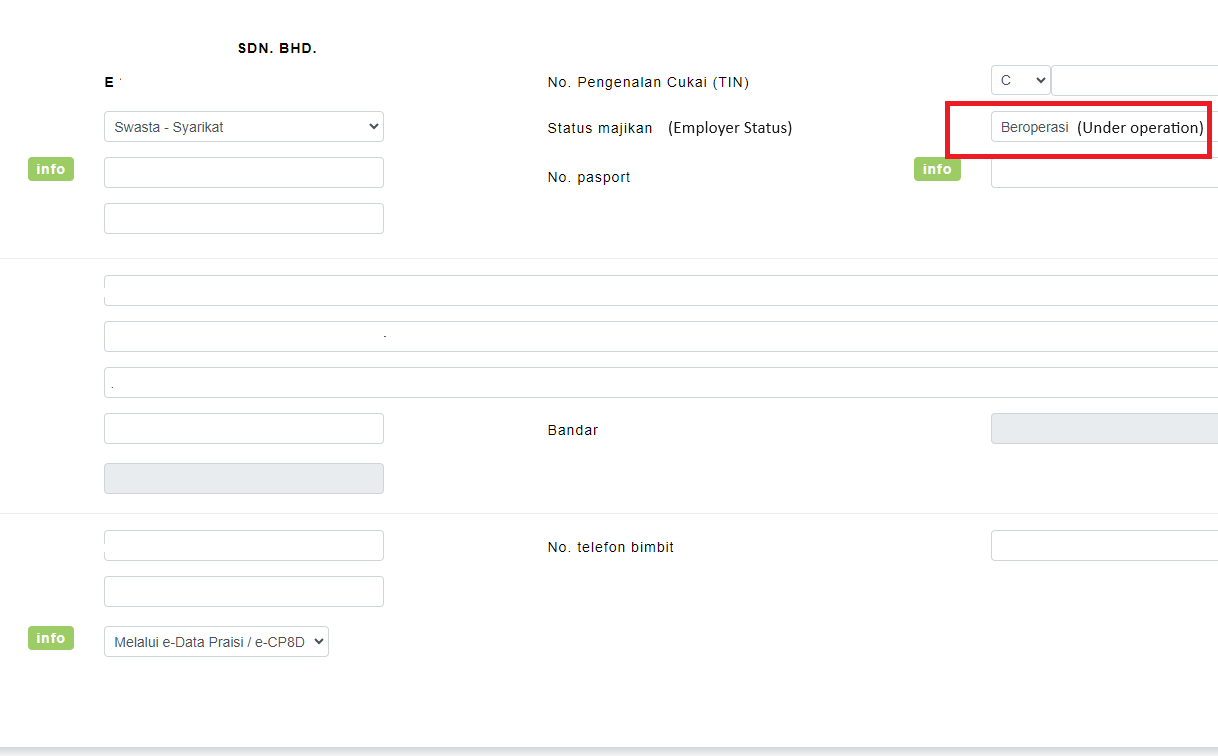

Step 9 – In the Employer status column, select ‘in operation’ (beroperasi) if your company is active. Please select ‘Dormant’ (dorman) if your company is inactive.

Step 10 – Enter the following employee details for the year 2023:

-

Total number of staff (including directors) as of 31.12.2023

-

Number of staff subject to PCB (Potongan Cukai Bulanan) during 2023

-

Number of new employees hired in 2023

-

Number of employees who resigned or had their employment terminated in 2023

-

Number of employees who left Malaysia during 2023

(For illustration purposes, we will use year 2023 as an example).

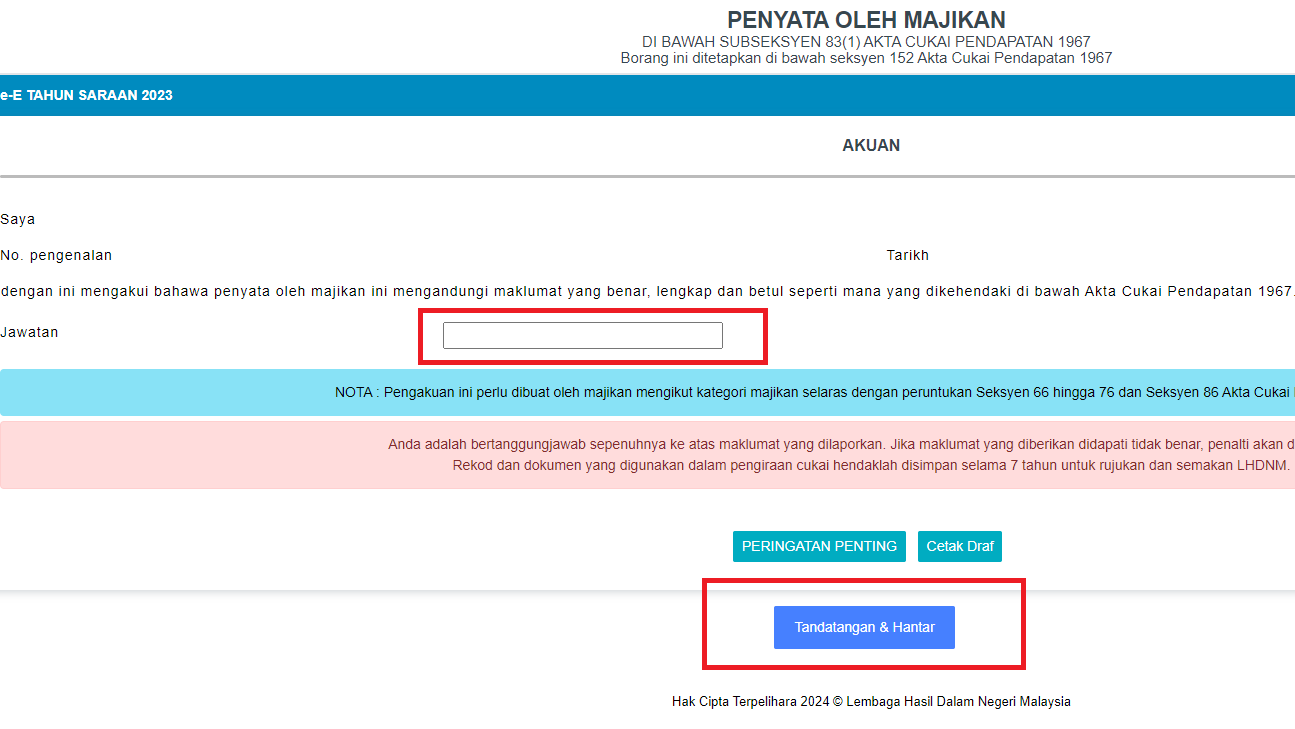

Step 11 – Make your declaration, then print a draft copy for review. Once everything is verified, click “Sign and Send” to submit.