How to use LHDN E-filing platform to file E form / Borang E to LHDN

ALL employers (Sdn Bhd, berhad, sole proprietor, partnership) are mandatory to submit Employer Return Form (also known as Borang E / E form) via e-Filing for the Year of Remuneration 2022 in accordance with subsection 83 (1B) of the Income Tax Act (ITA) 1967. on and before 30.4.2023 (e-filing)

ALL employers are reminded to prepare and provide the Yearly Remuneration Statement (EA and EC Forms) to all employees by 28.2.2023 to allow them to complete and submit their Income Tax Return Forms within the stipulated time frame.

DORMANT Companies must file FORM E

Companies which are dormant and/or have not commenced business are required to furnish the Form E with effect from year of assessment 2014.

Penalties up to RM20,000 or 6 Months Imprisonment

Please be advised that it is the employer’s responsibility to complete the form E and return it promptly to the Inland Revenue Board (LHDN).

Penalties ranging from RM200 to RM20,000 or to imprisonment for a term not exceeding 6 months or both will be imposed if you fail to comply with the stipulated filing date.

We have encountered many companies especially Dormant / inactive companies were unaware of this requirement despite numerous reminder given for the past few years.

Summon is awaiting you if you forget to file Borang E on time.

Whose responsiblity to file Borang E?

Director and/or the person incharge of payroll of your company. It is part of the internal Human Resource function. The person who handling your company monthly payroll, EPF, SOCSO, EIS, PCB should be the best person to handle because he/she has the full info and in out of all employees. This is not the duty of company secretary, auditor or tax agent. However your may consult them for advise if necessary, or engage them to assist you under separate/special engagement.

How to start?

Log on to https://mytax.hasil.gov.my/

Step 1 – Please use your personal income tax e-filing ID to log in. key in your NRIC or Passport number and password (请输入LDHN个人电子报税ID和密码)

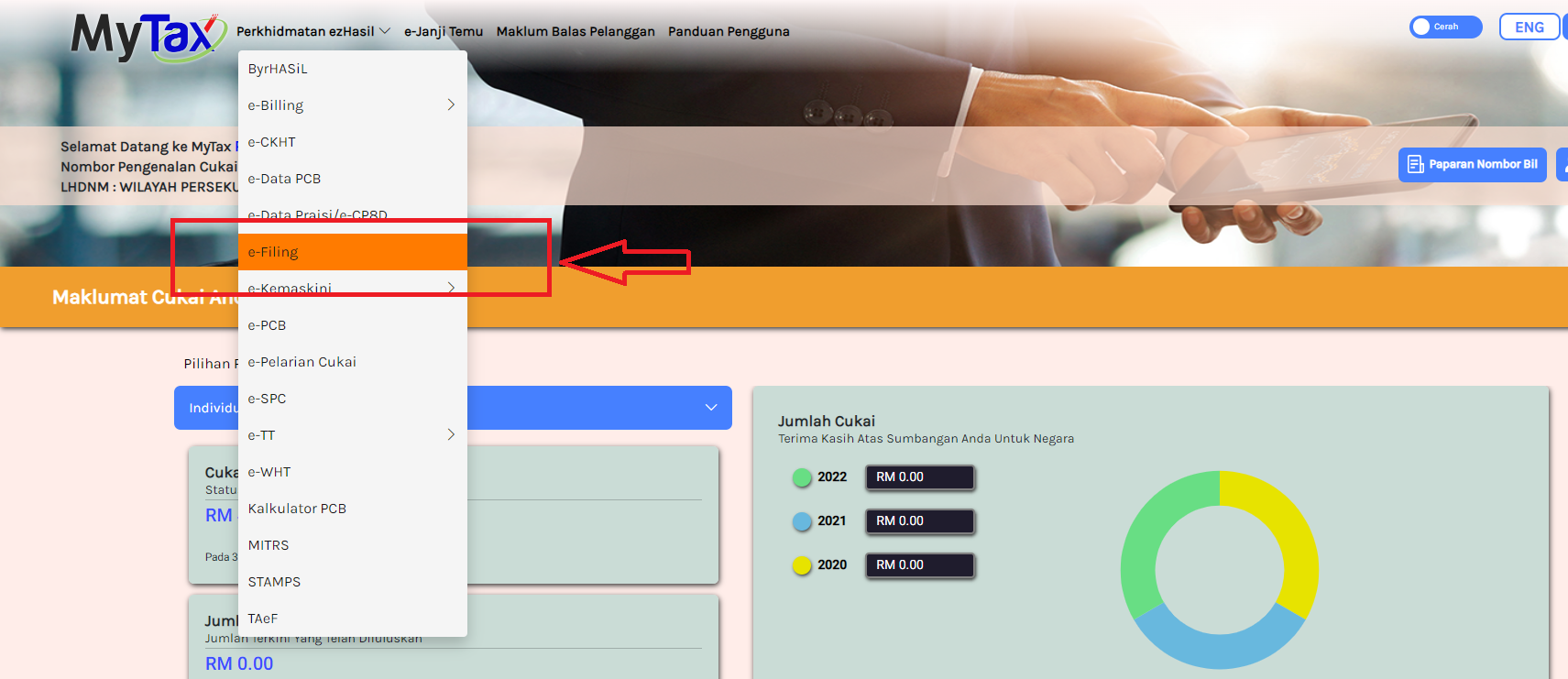

Step 2 – Go to ‘Perkhidmatan ezHasil’, then select ‘e-filing’

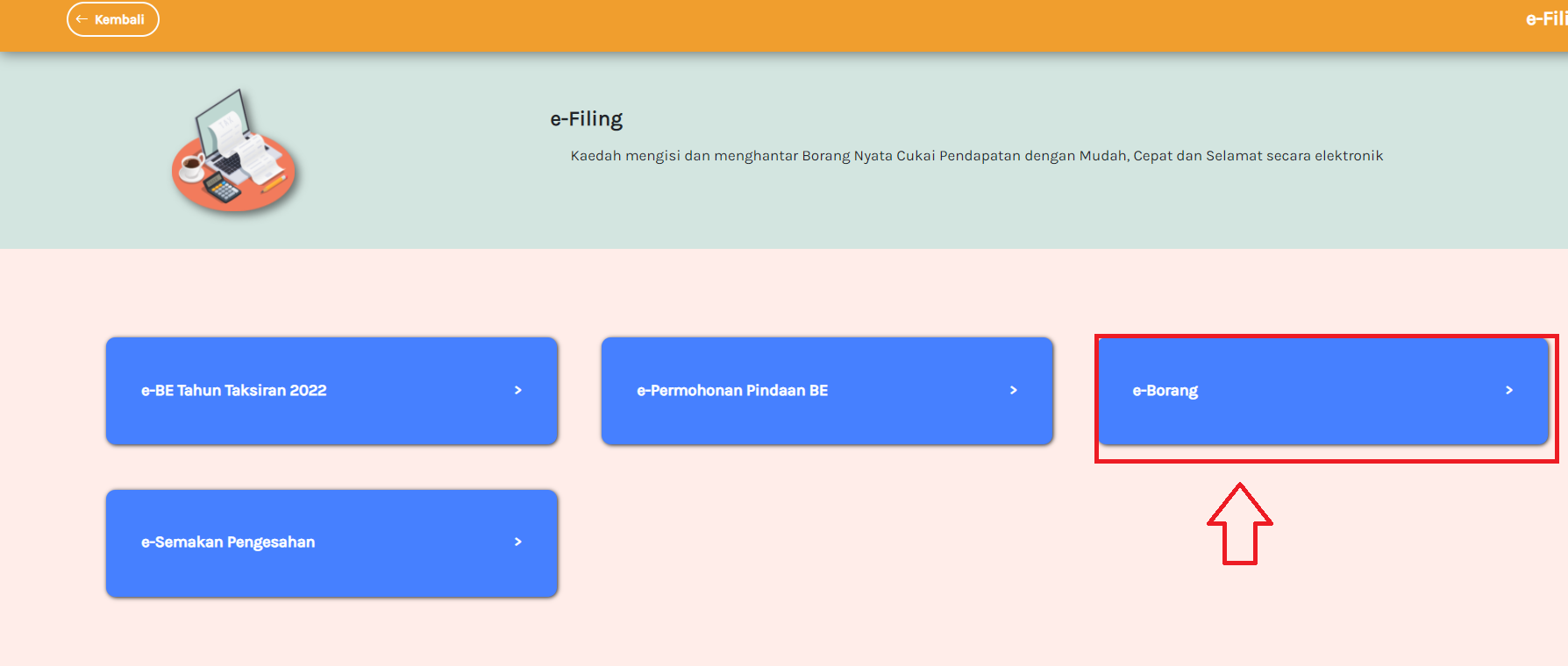

Step 3 – Select ‘e-Borang’ (请选择表格 e-Borang)

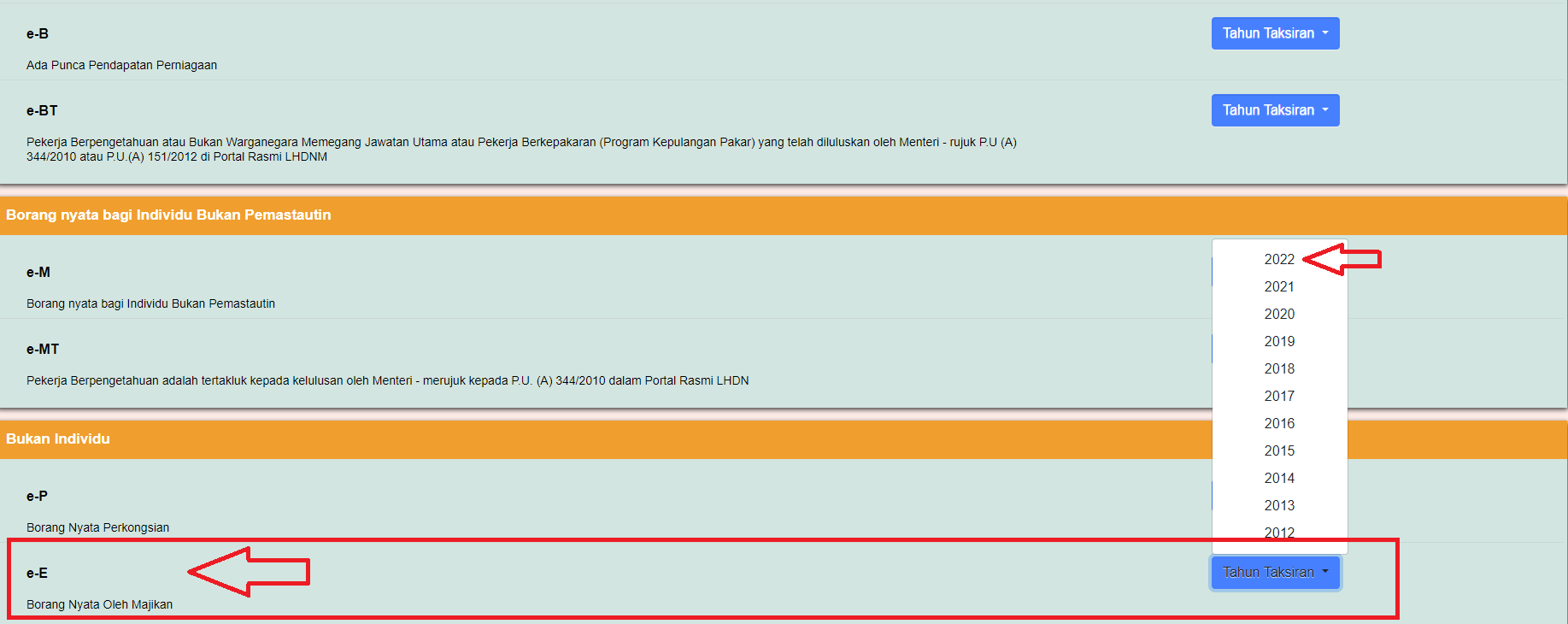

Step 4 – scroll down and select ‘e-E’ (请选择表格 e-E)and select year 2022 (请选择年份2022)

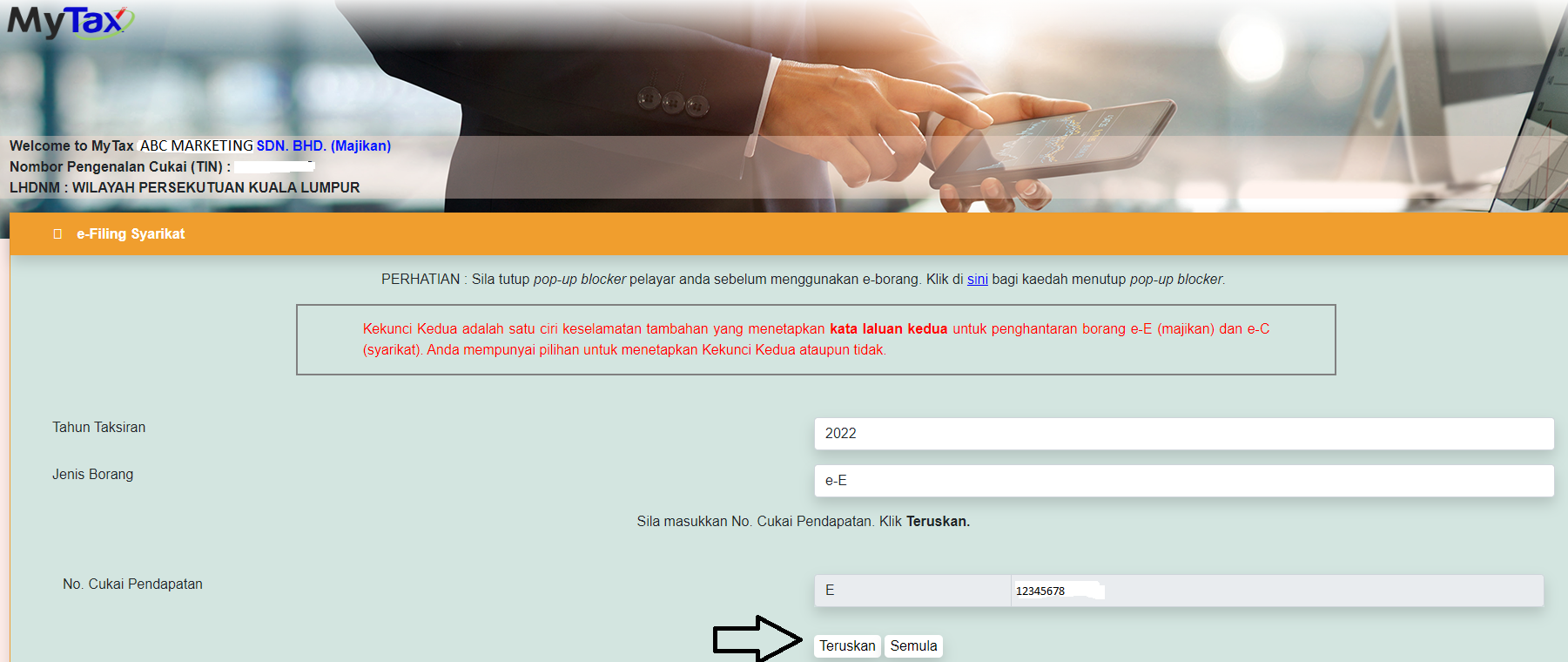

Step 5 – key in your company E number (Nombor Majikan) (请输入E号码。注意:E号码就是LHDN雇主号码)

Note: Every company should have 2 number. “C” number and “E” number. “C” number is corporate tax reporting number to report your company tax, commonly handle by your company tax agent. “E” number is employer number, commonly use it to report staff payroll monthly deduction such as MTD (PCB) and also filing E Form and issue EA form to employee (include director). E Form and EA Form are commonly self manage by company payroll staff or director, not necessary to appoint a tax agent. Please note that It is not the duty of company secretary or auditor to file for your company.

注意:每家公司拥有两个税务号码。C 号码通常用来呈报公司所得税,通常公司所的税由tax agent帮您代办, 不需要您处理。但是E号码是雇主号码,是用来呈报员工每个月薪金预付税务扣除,以及呈报年度员工(包括公司董事)薪金 (E Form)给LHDN, 以及发EA Form给每个员工。 E Form 是通常可以自行处理(由公司Director或HR staff呈交),不需要tax agent代办。(注意:这也不是公司秘书company secretary或审查司auditor的责任)

Step 6 – Congratulation, you are landed on e-E form Page. You may key in your company particular such as address, SSM registration number, email, Phone number etc. (恭喜您, 您已经登录E Form 表格, 请填上您公司的资料)

Employer Category column(kategori Majikan), please select:

-

If your company is a Sdn Bhd, please select ‘Swasta – Syarikat’ (有限公司请选择 swasta – syarikat)

-

If your company is sole proprietor, partnership or LLP, please select ‘Swasta – Selain Syarikat’ (个体经营或伙伴联营,请选择swasta – selain syarikat)

Employer Status column (Status Majikan), please select:

-

Beroperasi = Active company (活跃公司,营业中)

-

Dorman = Inactive company (公司停业)

-

Dalam Proses Pengulungan = company under strike off or winding up (公司正在清盘中)

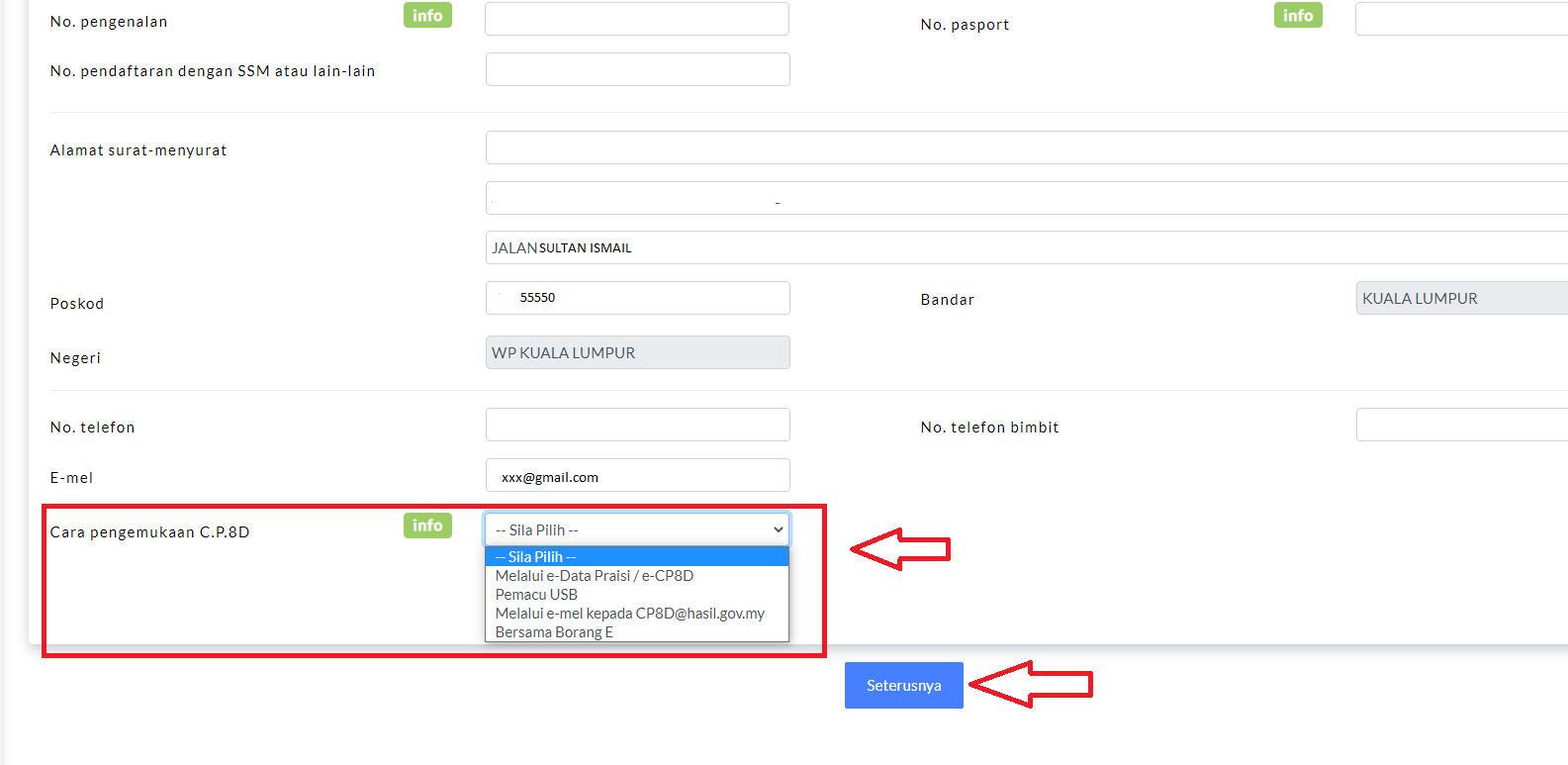

Step 7 – Select how you wish to send CP8D to LHDN (请选择您要如何呈交CP8D表格):

There are 6 selection:

-

‘Melalui e-data praisi atau e-CP8D’ = (upload CP8D form to thru e-CP8D). select this if you have payroll software to generate the file to Upload to E form(选项2 – 上载CP8D表格到E Form, 如果您有用payroll 软件, 您可以选择这个方式)

-

‘Pemacu USB’ = (use USB) (透过USB呈交)

-

‘Melalui email kepada CP8D kepada cp8d@hasil.gov.my’ = Submission of CP8D thru email (发电邮至税务局 cp8d@hasil.gov.my)

-

‘Bersama Borang E’ = (submit CP8D together with Form E) by key in manually all staffs (including directors) information, remuneration, Benefit in kind and so on. (选项1 – 和E Form一起程交,手动注入所有员工资料,员工薪金,员工福利)

What is CP8D? CP8D is a form to to declare all staffs particulars including salary, bonus, benefit in kind received by each employee (include directors)

Note: For dormant/inactive company, please select ‘Bersama Borang E’ and key in at least 1 director info as employee. (空壳公司或冬眠公司请选择‘bersama Borang E’, 输入至少一位董事资料。在法律上董事其实是公司员工).

Frequent ask question (常问的问题):

Which one to select? (选那一项?)

Option 1 ‘Bersama Borang E’= select this if your company doesn’t use any payroll software to run monthly payroll or your company is dormant. manually key in employee or director info (选1, 如果您的公司没用工资软件app, 自行手动输入员工或董事资料)

Option 2 ‘Melalui e-data Praisi / e-CP8D’ = Select this if your company using payroll software. consult your payroll software provider of how to download TXT file and upload it to e-CP8D in MyTax (选2, 如果你的公司有用工资软件app,请联络软件供应商咨询如可下载txt file).

If you wish to learn how to use e-data Praisi / e-CP8D platform in MyTax, click on the following link:

https://clpc.my/how-to-use-file-cp8d-via-e-cp8d-in-mytax-platform/

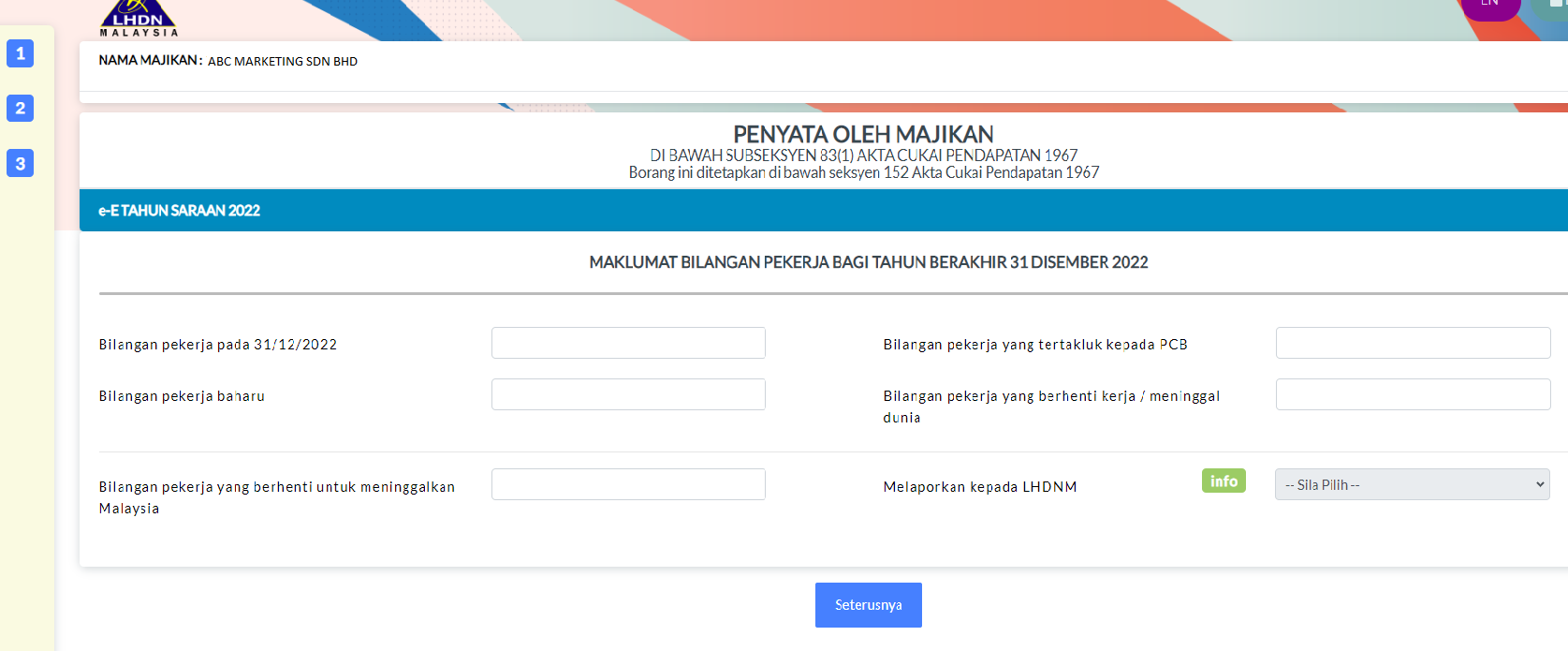

If Selcct ‘Bersama Borang E’ , you will be landed on the page below. Please follow the following steps to complete the submission:

Step 8 – key in number of staffs (include director) as at 31.12.2022, number of staff subject to PCB during the year 2022, number of new employee, number of staff resigned/terminate employment, number of staff leave Malaysia during the year. (请输入员工2022年人数,员工交PCB的人数,新员工人数,员工辞职人数, 员工辞职后离开大马的人数。

Press ‘Teruskan’ (continue) 完成后请按’teruskan’

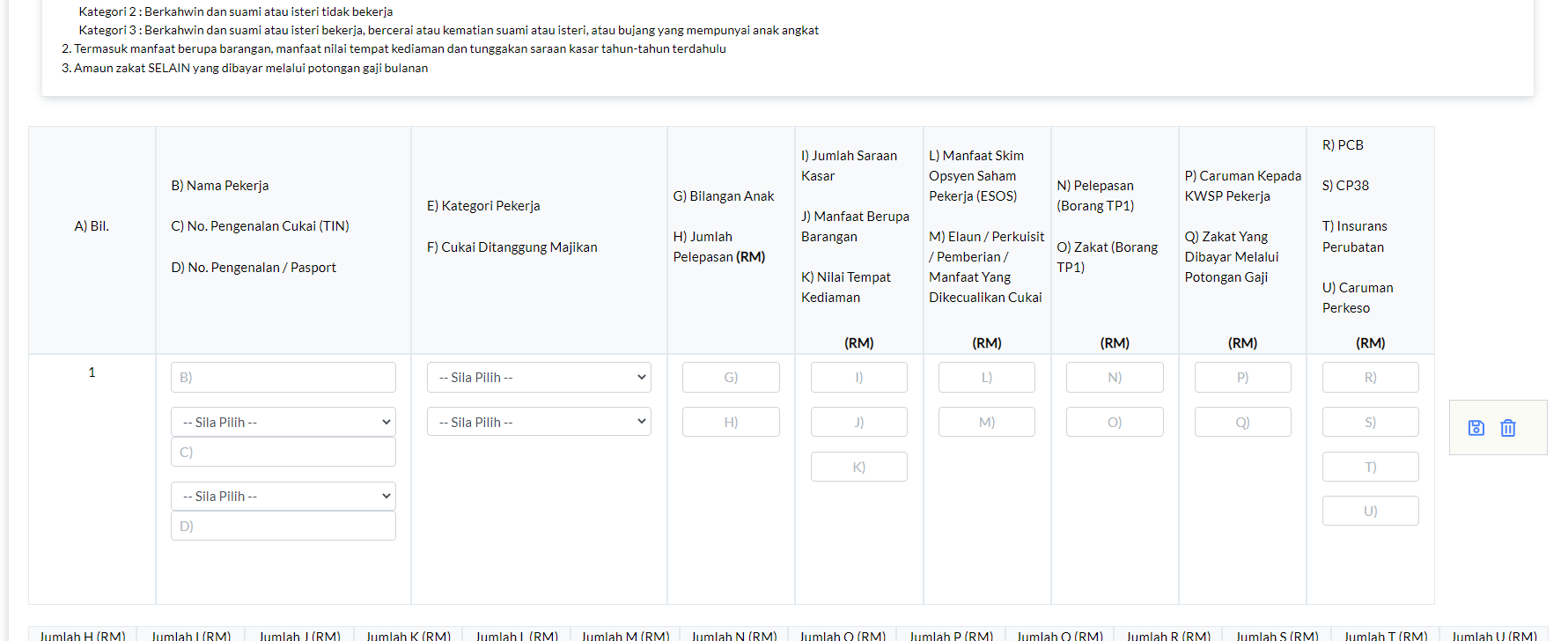

Step 9 – Now you are landed on CP8D form.

Now you may manually key in all staffs (include director) payroll information such as name, tax number, NRIC or passport number

Select Category of employee:

-

Category 1 – Bujang [single],

-

Category 2 – Berkahwin,suami/isteri tidak bekerja [married, husband/wife not working],

-

Category 3 – Berkahwin, suami/isteri bekerja [married, husband/wife working], employees’ remuneration received, benefit in kind received by employee (include director).

Select Employer pay tax for employer: NO (Tidak)

You may put ZERO (0) the whichever column not applicable to your employees. Click ‘Save’

Press ‘Continue’ or ‘teruskan’

STEP 7- 如果您没用payroll软件, 请选择 “Bersama Borang E” (submit together with E Form)。 您将会登录到CP8D表格。 现在您可以手动模式填入所有员工资料,员工身份证,员工类性(1 – bujang [单身], 2- berkahwin, isteri /suami tidak bekerja [已婚,丈夫或太太没做工] 3- berkahwin, isteri/suami bekerja [已婚, 丈夫或太太有做工],员工薪金,福利 (包括公司董事)完成后请按 ‘save’, 然后按‘teruskan’

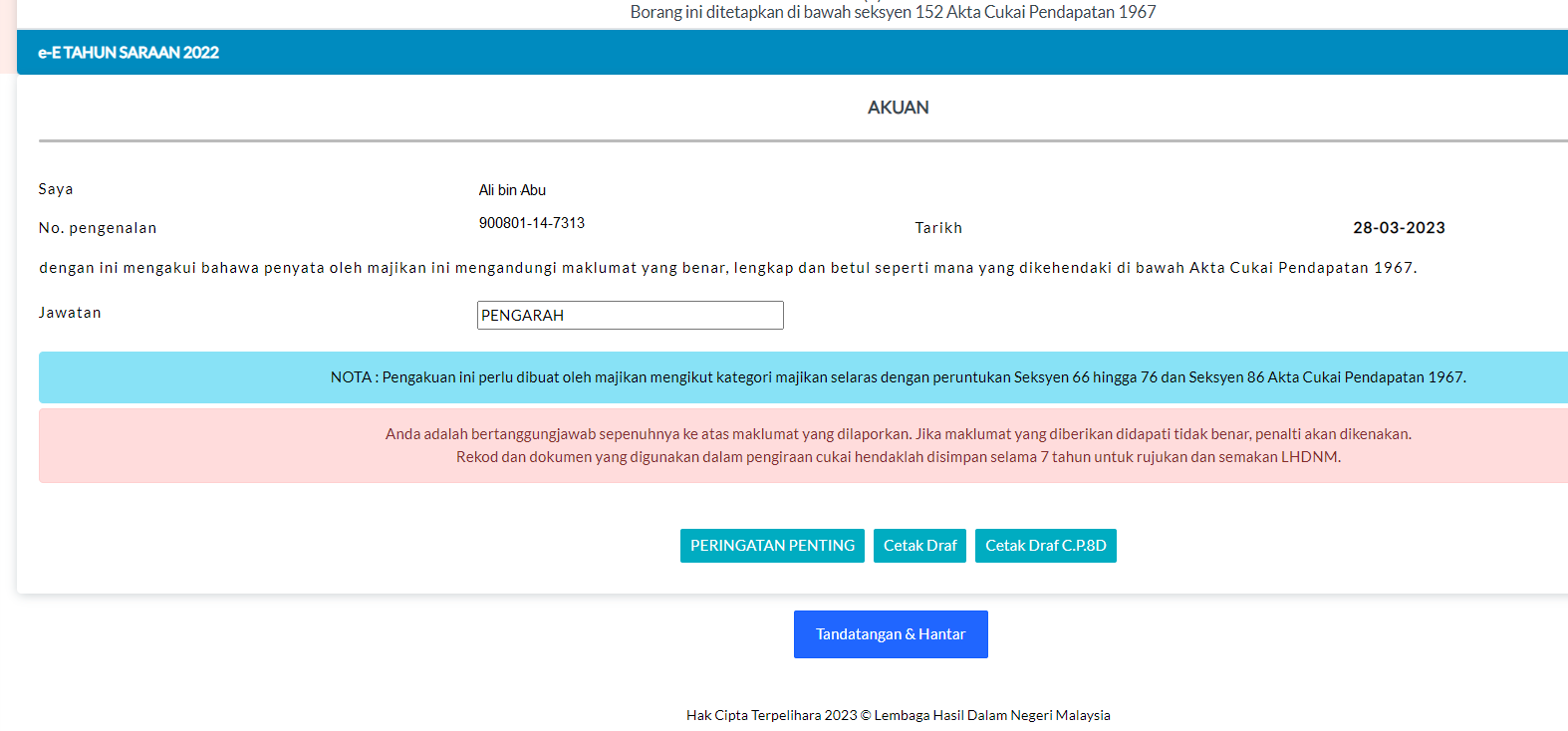

Step 10 – Sign digitally to submit your e-E Form to LHDN.

Please remember to print the acknowledgement slip from LHDN to confirm acceptance of your submission. (您已经完成填写,请继续,透过电子呈交完成发送。呈交后请记得打印acknowledment slip.