What is E- TT?

It is a system used to generate a Virtual Account Number (VA Number) which will be used as a payment identification.

Effective 1 April 2022, taxpayers must obtain a VA Number if they wish to make payments through Telegraphic Transfer, Electronic Funds Transfer and Interbank Giro from within and outside Malaysia. Each VA Number can only be used for one transaction.

The VA Number generated under the e-TT system caters for the following types of taxes: –

- Income tax

- Withholding tax (one number for one payee)

- Petroleum income tax

- Compound

- Public entertainer

- Real Property Gains Tax – Section 21B retention sum payment

Please refer below for the guidelines to generate a Virtual Account Number (VA Number)

For this example, I will be generating a VA Number to pay Income Tax Instalment (CP204) for company  1. Go to https://mytax.hasil.gov.my/

1. Go to https://mytax.hasil.gov.my/

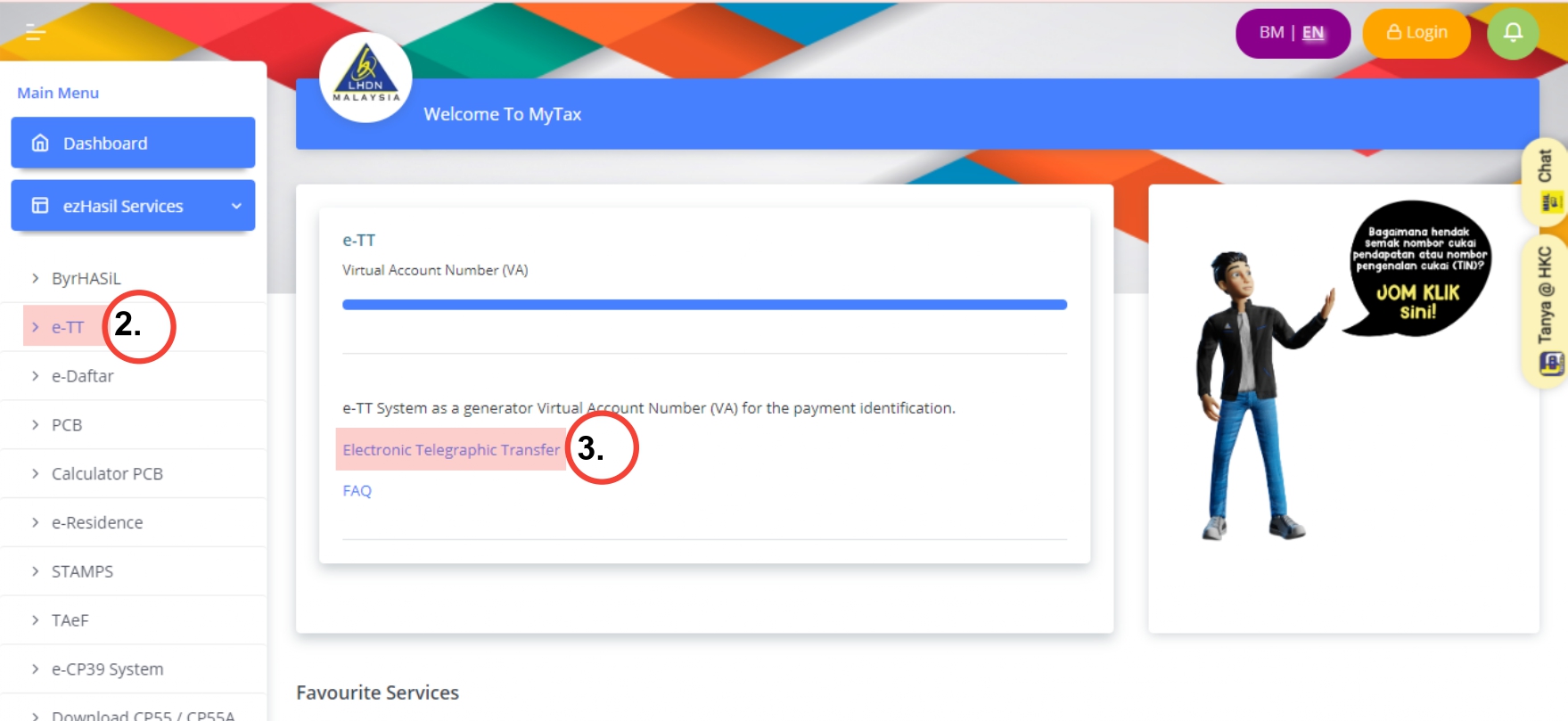

2. Click ezHasil Services and select “e-TT”

3. Then select “Electronic telegraphic Transfer”

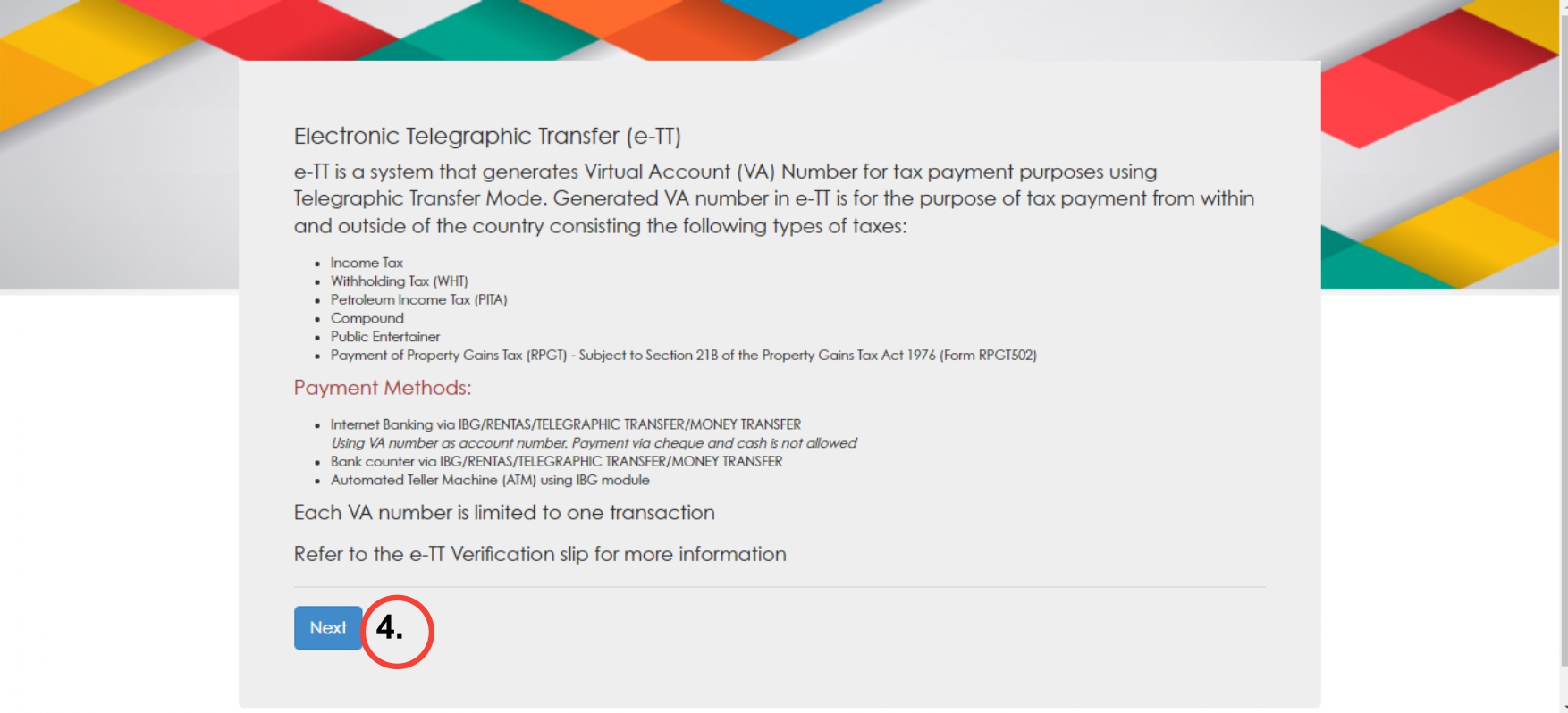

4. Click “Next”

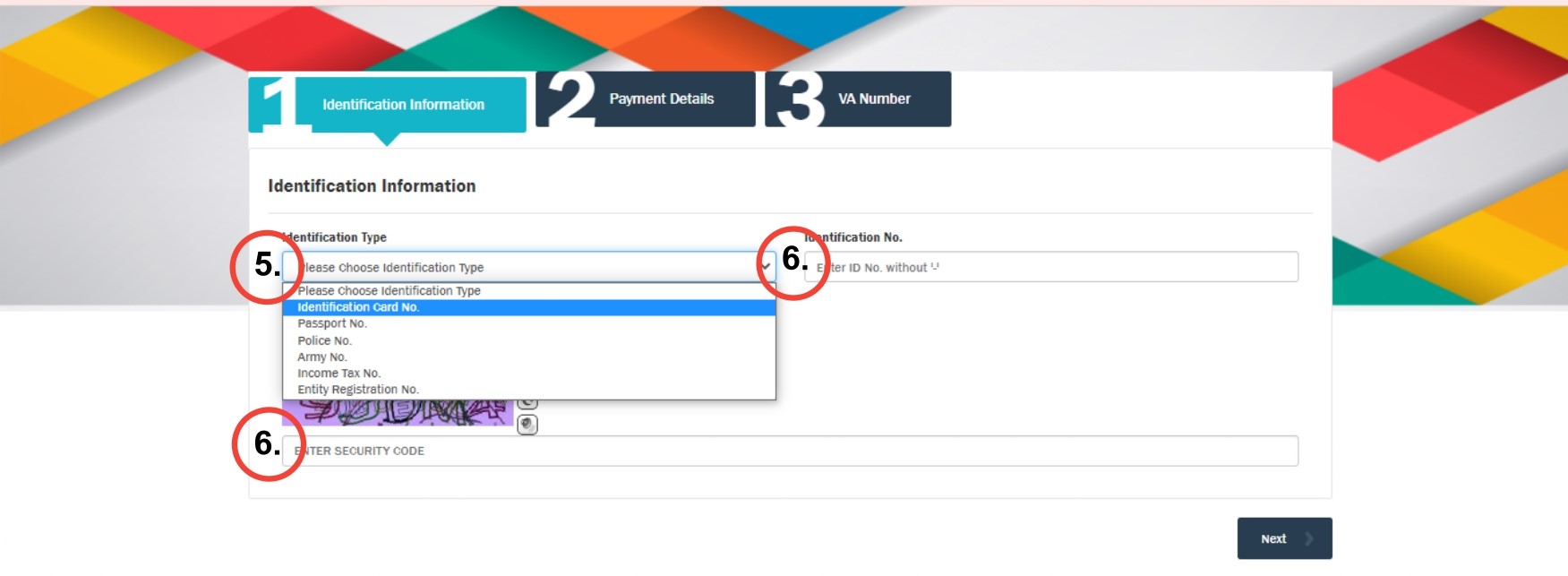

5. Choose identification type

5. Choose identification type

6.Fill in all the necessary information and security code

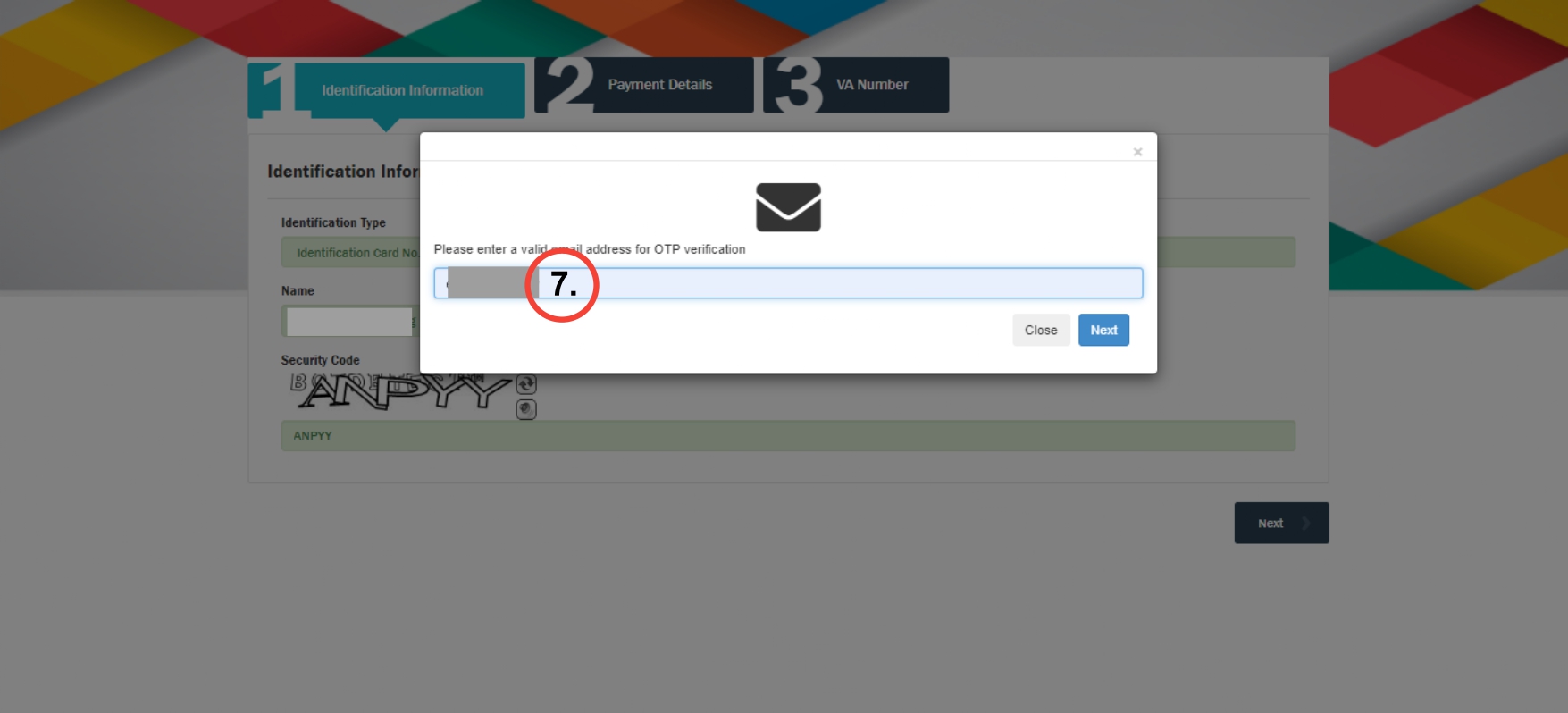

7. Fill in the email address to obtain the OTP then click “Next”

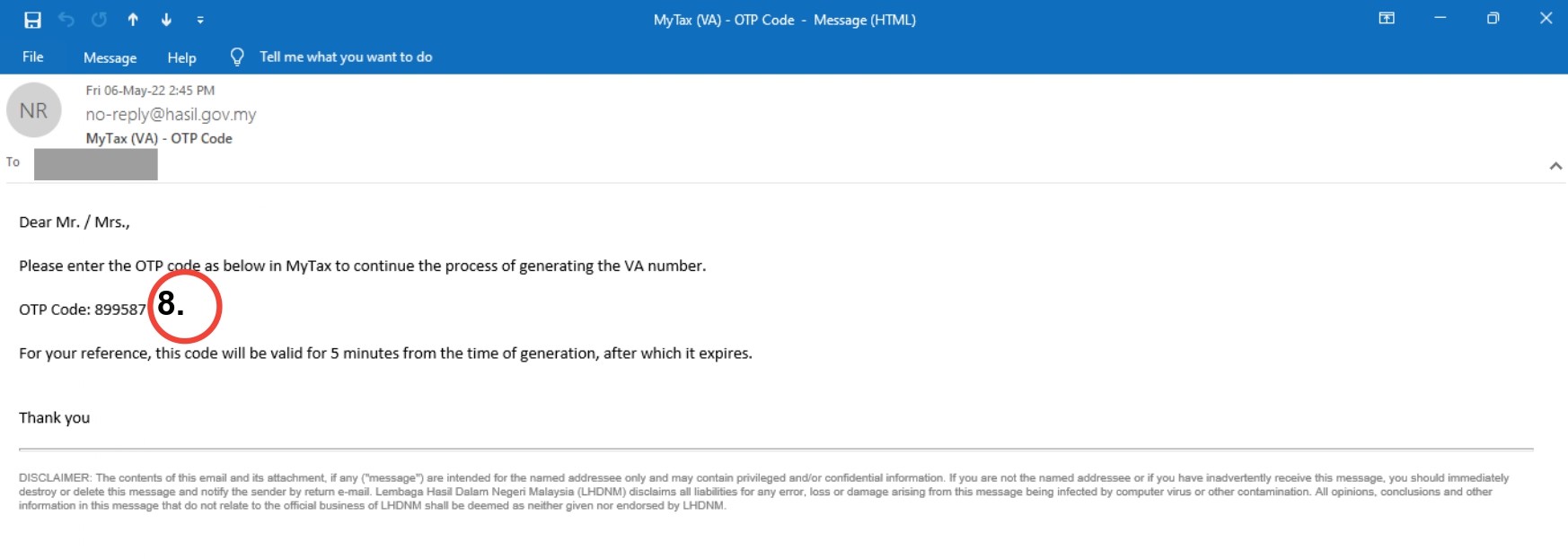

8. Obtain the OTP from the email address entered into at No.7 and enter the OTP

8. Obtain the OTP from the email address entered into at No.7 and enter the OTP

9.Select “Cukai Pendapatan (Income Tax)”

9.Select “Cukai Pendapatan (Income Tax)”

10. Select “Syarikat (Company)”

11. Enter Income Tax No. of the company (please add a zero “0” at the end of the Income Tax No. to proceed) and address

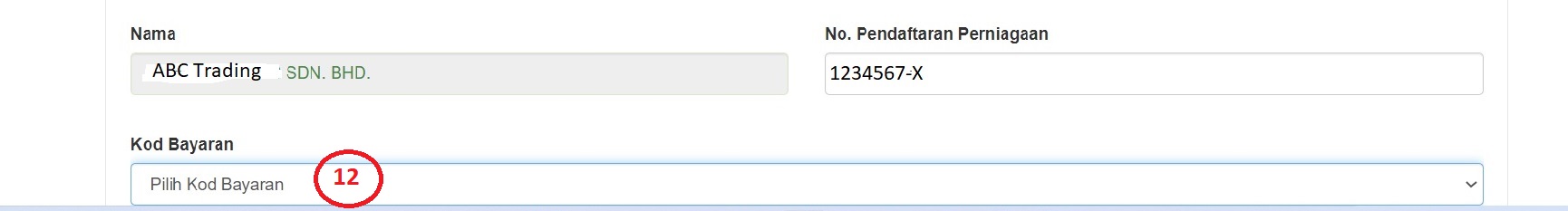

12. Enter “Kod Bayaran (Payment code)”. for Code:086 (company CP204 Instalment), Code: 084 (Individual CP500 Instalment), Code 095 (Final income tax – other than instalment)

13. Enter “Tahun Taksiran (Year of assessment)”

14. A summary of the Payment Details will be shown. Then click “Next”

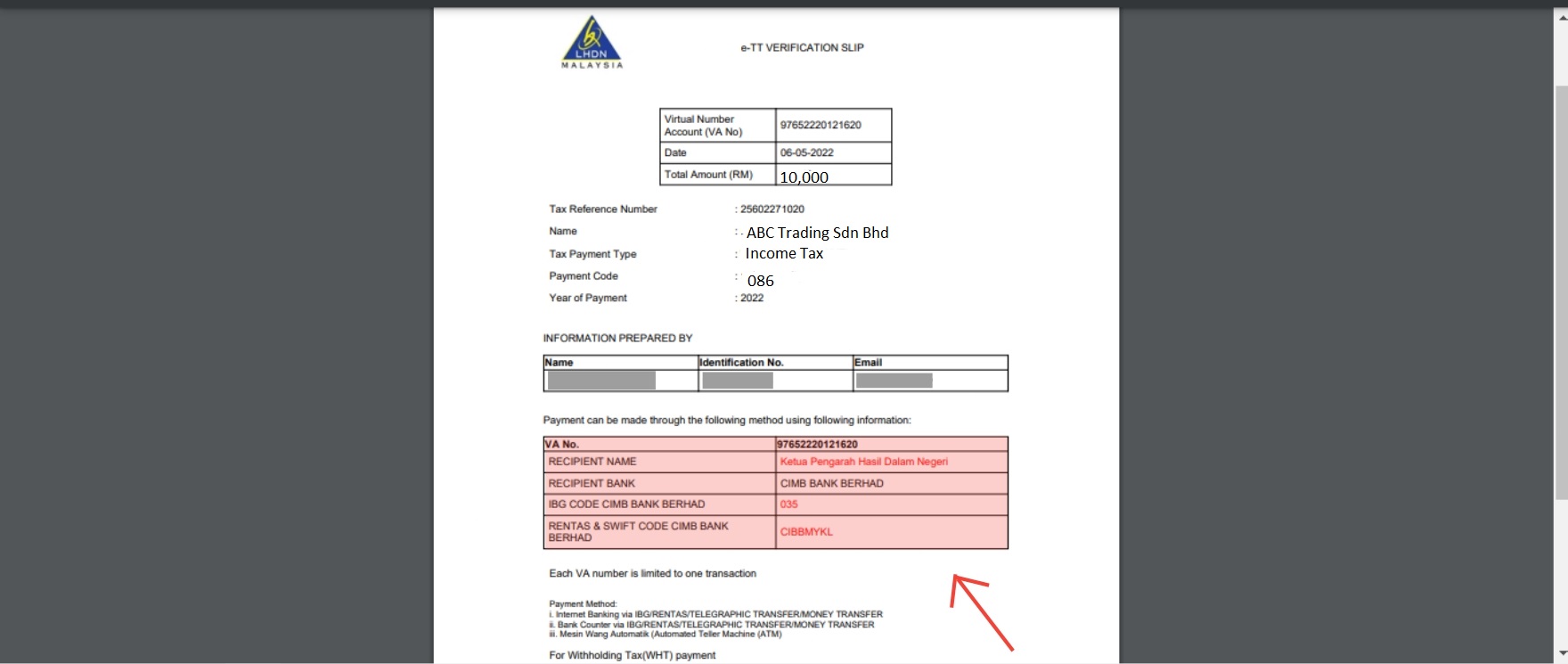

15. Click “Print” and save a copy to your desktop. The VA Number is the one (highlighted in pink on the above image) and the image below is the saved copy of the generated VA Number and it contains the information you need (highlighted in pink) to be entered to make payment.

Thank you and I hope you are able to generate your VA Number with ease!

After generating the VA Number, you may proceed to make payment of the Withholding Tax via the following:

- Online banking portal fund transfers IBG/RENTAS/Telegraphic Transfer/Electronic Fund Transfer (EFT)

- Payment from overseas require SWIFT Code : CIBBMYKL

- Bank Counter: IBG or Telegraphic Transfer

- ATM : Multiple ATM machines support IBG Interbank Transfer transactions

*Kindly take note that the VA number provided should be used as the payment account number while making payments via the TT method at bank counters or through electronic banking portals*

Thank you and I hope you are able to generate your VA Number with ease!

After generating the VA Number, you may proceed to make payment of the Withholding Tax via the following:

- Online banking portal fund transfers IBG/RENTAS/Telegraphic Transfer/Electronic Fund Transfer (EFT)

- Payment from overseas require SWIFT Code : CIBBMYKL

- Bank Counter: IBG or Telegraphic Transfer

- ATM : Multiple ATM machines support IBG Interbank Transfer transactions

*Kindly take note that the VA number provided should be used as the payment account number while making payments via the TT method at bank counters or through electronic banking portals*